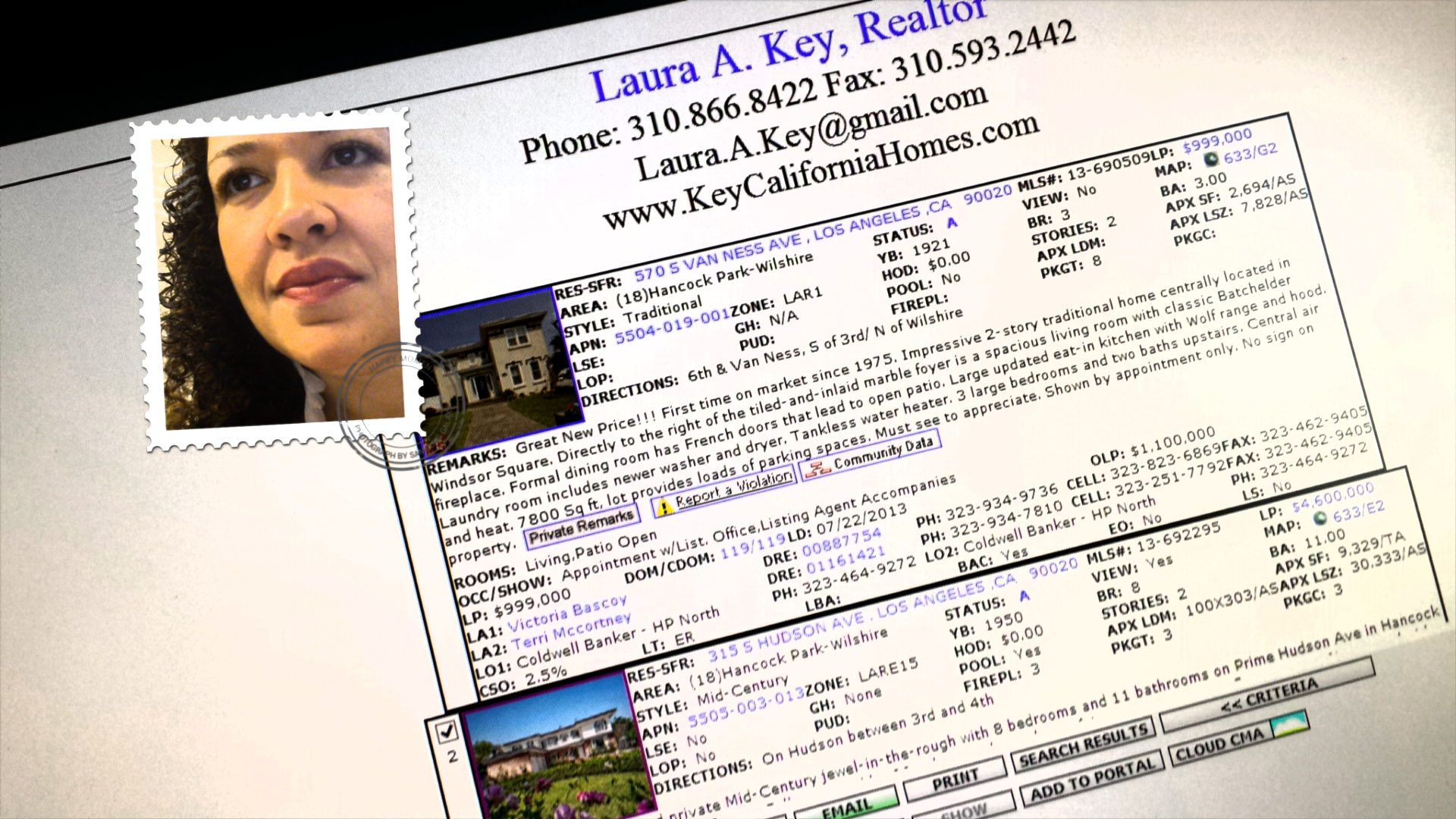

BLOG

Hard at Work In Real Estate

Looking for A New Home? Text LKHOMES to 87778 to get instant free access to the MLS! Or Call me at 310.866.8422

Homes are turning over quickly in Los Angeles! Let me work hard for you!

California Real Estate, Los Angeles Homes, Homes for Sale, Larchmont Homes for Sale, Hancock Park Homes for Sale, Windsor Square Homes for Sale, West Hollywood Homes for Sale, Koreatown Homes for Sale, Realty Goddess, Top Los Angeles Real Estate Agent, Real Estate Agent, Realtor, MLS, Home Search

FHA Limits for Los Angeles Area

Homeownership is not out of reach. FHA limits in California are one of the highest in the country. I have great lenders that can help you reach your real estate goals! Call me to get started on your homeownership goals!!! Laura Key 310.866.8422

Here are the current limits for Los Angeles (as of August 23, 2013) FHA allows 3.5% downpayment over a 15 to 30 year term!

Single Family $729,750

Duplex $934,200

Tri-Plex $1,129,250

Four-Plex $1,403,400

Source: FHA.com

5 Things You Should Know Before You Flip A Property

Money is made at the buy, not the sell of your flip. When flipping a house your money is made at the purchase not at the sell of the house. So, many times people buy a house with the intentions of making a huge profit only to find out that they could not make any money after all the renovations because the purchased price of the house was to high.

1. Money is made at the buy, not the sell of your flip. When flipping a house your money is made at the purchase not at the sell of the house. So, many times people buy a house with the intentions of making a huge profit only to find out that they could not make any money after all the renovations because the purchased price of the house was to high. When you purchase your property you need to be sure that you buy the house with enough money to make renovations, have carrying cost, and add about 5 $6,000. Now, cost is at $147,000, and that is if everything goes as planned. Profit is under 10,000 dollars. The mistake was made at the purchase at the home, not the sell.

2. Get an inspection on the home - Get a complete inspection done on your property. By, spending a few hundred dollars on this expense you can save thousands in problems that you cannot see. Foundation, Pest, Wood Rot, Etc... By, getting a full inspection you can rest assured that you know every thing that is wrong with the property before its to late. In the contact for the house you need to make sure that you have 7 days to have a inspection preformed, and if the inspection finds problems that are going to cost more money that you are willing to spend you can get out of the contract with no penalties.

3. Don't do the work yourself: - Get a contractor or several sub-contractors and have the work done quickly. You need to have you house flipped ASAP, so that you can get it on the market and get it sold. When I started flipping my brother and me did a house together, and we did all the construction. I had a construction background and figured it would save thousands, but it took us over 4 months to get the work done that a contractor could have had the work done in a month. But, we trying to save money on our flip did all the work on our time off and after work, and it just took to long. On our 2'nd flip we used contractors for almost everything and had the house completely flipped with a new roof, new air conditioning, new hardwood, and much more in only 3 weeks. We did not have to spend all our time working on the property and were able to spend that time looking for the next deal. This is how you get rich in real estate.

4. Place the property 1 to 2 percent below market value: If you are wanting to flip real estate and make money the object is to buy and sell the property as quickly as possible, so that you can move on to the next house. If you purchase a house and try to sell it at top dollar to make and extra couple of thousand dollars on your flip, and end up holding it for 6 months you are loosing money. Get the house on the market at a price that is going to blow the competition away, and you will sell it no matter what the market conditions. On our second house the market for selling house went down do to the housing market as a whole, and the tightening of the loans across America. We were told that you could not sell a property in this market, but we went ahead anyway and flipped our house. After 3 weeks on the market we had 3 people wanting to buy the house. Why, because we offered it at such a great deal that people wanted to jump on it. That is what you have to do especially if the market is slow.

5. Use a real estate agent - Do not try to sell you house on your own. Harness the power of a real estate agent and the power of the MLS system. When you do a FSBO you are depending on people driving by your house and seeing you sign, with a real estate agent you have someone actively marketing you house to get it sold. Once again this will free up more time for you to look for more great deals. If you want to help the process I have found that craigslist and listing you house in google adwords help to, but use these tools with the help of a agent such as Laura Key to make sure I have all my bases covered.

I hope this article has been helpful with the basics needs of flipping a house. If you will study and learn you will make money. But, do your homework before you purchase a house, and make sure that you can pull a profit on your deal. Then, make it happen! I am a Investor Friendly Agent, let's get you some deals! Laura Key 310.866.8422

Laura Key on CBS News

Great Burbank HUD Home! 2 Bed 2 Bath

HUD Homes are a wonderful way to purchase your first home! Most are FHA approved and don't need much work at all. Make sure you use a HUD experienced agent as myself! I have helped many families obtain their Home Dreams with HUD! Call me today for more info! Laura Key 310.866.8422

2359 N. Reese Place

Burbank CA 91504

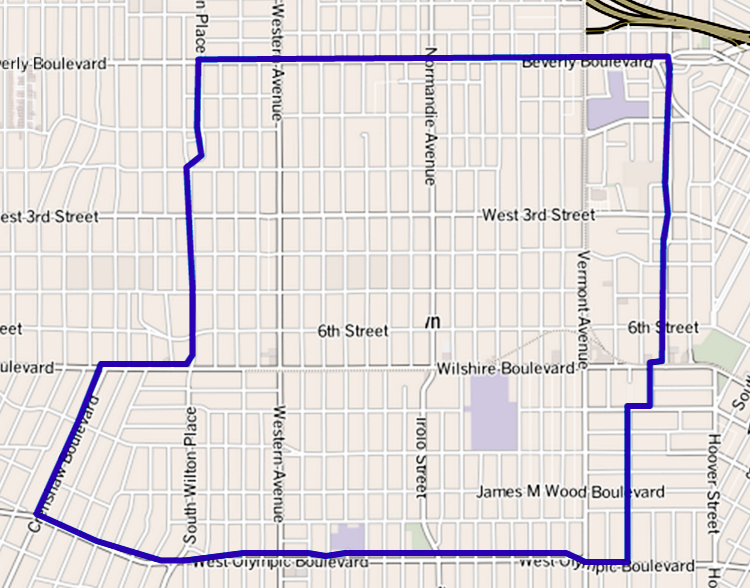

Living in Koreatown Los Angeles

Los Angeles is home to so many wonderful areas to live in. If you are interested in Koreatown, give me a call! Laura Key 310.866.8422 or just click the Koreatown Ball below!

Koreatown is a wealth of history and excitement! You can hardly take two steps without finding a new place to eat or shop! I must admit, after living here for almost two years I have not even scratched the surface of what is offered in this great area of Los Angeles until I saw the CNN Special with Anthony Bourdain Parks Unknown! Sometimes the boob tube can really spur you into action.

Koreatown is a wealth of history and excitement! You can hardly take two steps without finding a new place to eat or shop! I must admit, after living here for almost two years I have not even scratched the surface of what is offered in this great area of Los Angeles until I saw the CNN Special with Anthony Bourdain Parks Unknown! Sometimes the boob tube can really spur you into action.

I decided it was time to visit some of the places shown during this special. My first adventure was trying Myung In Dumplings located at 3109 W. Olympic Blvd. The power of TV had already overwhelmed this place. The first time my husband and I visited they had sold out of most of their menu, so we attempted to fill our bellies on another day! On our second visit we were able to order the #1 which is meat and veggie dumplings. While we were in line waiting it was such a pleasure to watch the owners actually making the dumplings by hand. It's something about seeing loving hands prepare food. Reminds me of growing up in Kentucky and our Sunday dinners! For $7 we were given four nice sized fluffy dumplings filled with yummy delights on the inside! Along with our dumplings we were given a few kimchee delights!

Overall, it was a very pleasant outcome to my first new adventure of Koreatown! Join me on my next adventure in the near future!

Interested in living in Koreatown? Please visit my website to search for homes FREE! Just click the map below! Or...call me, Laura Key 310.866.8422

What to Expect At a Foreclosure Auction

Whether you are an investor that would like to get into buying foreclosed homes for your personal use! Call me today! Laura Key 310.866.8422

Whether you are an investor that would like to get into buying foreclosed homes for your personal use or to flip the property or if you are having your home foreclosed on, you should know what to expect at a foreclosure auction. Of course, the actual steps that will be taken can vary a bit from state to state and from house to house, but it’s good to know what you will be getting into when you go to a foreclosure auction. Foreclosure auctions can be exciting, even fun, but knowing what to expect will help you make the most of the experience, whether you are an investor or a homeowner that is trying to get your house back.

Before the Auction

You’ll likely find out about the foreclosure auction in a local newspaper and on the flier may be information to pre-qualify for bidding. This will allow you to put down a deposit so that the auctioneer knows that you are a serious bidder and can fulfill your bid if you are the winning bidder. Being pre-qualified just sort of speeds up the process so that you don’t have to mess around with the deposit on the day of the auction. During this time you should also do some research on the house by looking into any liens that may be against the property, how much the property is worth, how much it has appreciated in the last few years, as well as property values in the area. If the home looks as though it will need some repairs, you should consider this as well when trying to come up with how much you will be willing to pay for the house. Without this research, no amount of knowledge about what goes on at a foreclosure option will help you because you won’t know where to start when it comes to actually making a good bid.

What Happens At the Auction

The auction will typically start with the auctioneer reading legal notices as well as a legal description of the property. The auctioneer will usually then begin taking bids on the property. If the auctioneer has pre-qualified bidders the process is more streamlined, if not, each time a bid is made the auctioneer will then ask for the bidders deposit check, which is typically right around $5,000 for residential auctions. After each bid the auctioneer will attempt to solicit bids for higher amounts. Each auction is different, but the auction increments usually are set by the auctioneer and may be by $100, $500, or $1,000 per bid. The auctioneer will continue to solicit bids by this increment until it is clear that the highest bid has been reached. Then, the auctioneer will announce, “Going once, going twice, three times, sold!” indicating that the auction is over and the property has been sold to the highest bidder.

Once the bidding has ended a foreclosure deed and purchase papers will be drawn up and validated by the new owner or purchaser and the mortgage holder. A grace will likely be given to allow the purchaser to find financing or to come up with the funds to cover the full amount of the bid. This grace period is usually 30 days unless the purchaser and the mortgage holder agree to other terms. After the grace period a closing will take place, so that the new owner can formally take the title to the property.

What Happens, Now?

The purchaser can do what he or she intended to do with the property, whether it is to move into the home or to sell it for full market value. The money paid by the purchaser will be distributed in order of priority, first of which would be taxes. After taxes money will be paid to the mortgage, then the second and third mortgage if applicable. If there is still money after paying these debts, remaining money will be paid to lien holders and creditors. There is a very slim chance that there will be money left over after all of the debts are paid, if this is the case then the monies will be paid to the former home owner.

What about the Original Owner?

The original owner will often be at the auction so that they can bid on their home, and this is legal as long as they have the deposit required. If the owner of the home that has been foreclosed does bid on the home they must remember that the deposit is not refundable and the deposit assumes that they will be able to finance the home within the grace period. Owners must also remember that if they buy the property back old debts may merge and become reinstated such as second and third mortgages that became void when the first mortgage foreclosed on the property unless one has filed bankruptcy and is truly free and clear of these debts. Owners will often drum up the funds to make the deposit so that they can have another 30 days to try to save their home. Owners may or may not be successful in their attempts to save their home at a foreclosure auction.

As you can see, there are a lot of things that go into a foreclosure auction, but none of them are all that difficult to understand, but knowing about them makes the auction more enjoyable. The auction itself is not all that complicated, but it can be very fast paced. At some foreclosure auctions there are a lot of people, at others there are only a few because of the location or just the debts attached to the property, or even the state of the property. If you are serious about the property you should pay close attention when bidding starts so that you are sure that you can get your bid in when you feel it’s time so that you have the best chance of being the top bidder.

Call me for more info! Laura Key 310.866.8422

In A Hot Market...Bid First...See House Later

The market is so hot right now it seems the only way to even have a chance at purchasing a home is to put your offer in a contingency to view and inspect the property. What are your thoughts on this process? Is this creating another false bubble? Laura.A.Key@gmail.com

As soon as it hit the market, the four-bedroom Sea Cliff home inspired a bidding war, with the top two prospective buyers both offering well above the multimillion-dollar listing price, in cash.

In today's fevered real estate market, that's no longer unusual.

But there was a twist: Both bidders were located in China, and both made their big-bucks offers without ever setting foot in the house. One of them ended up buying the house for $3.1 million, substantially above its $2.8 million list price.

"At first, I was really, really surprised and kind of suspicious," said Nina Hatvany of Pacific Union, the listing agent. "I was concerned that they hadn't seen the property. After all, they might not like it when they saw it."

But since both offers looked serious and included proof of funds, "I said to the sellers, 'This seems like a new buyer profile. You might as well take it.' "

Buying homes sight unseen is a small but growing trend in the Bay Area, fueled by the over-competitive market and burgeoning interest by international buyers - and enabled by technological advances.

Buyers might make offers without seeing a house for several reasons: They live elsewhere or are away for business or personal reasons; they had scheduling conflicts and couldn't visit before bids were due; they're investors accustomed to buying just based on property characteristics; or they're taking a scattershot approach of making lots of offers and seeing which get accepted.

Not completely blind

Today's array of tech tools means they're never truly buying in the dark, however. Besides extensive photos and video tours of homes for sale, plenty of websites offer the chance to learn about neighborhoods and schools, and research comparable sales.

Often, those who bid sight unseen have a chance to tour the house during escrow and can still back out. But sometimes, as in the Sea Cliff case, they're willing to pay huge amounts based on photos, videos and their agent's recommendation. (The winning Sea Cliff bidder also had a family member visit.)

Professional investor Paul Livson of Danville has been buying and selling properties for 30 years, both for rental income and to resell. Bidding before visiting is a tactic he and others increasingly adopt, he said.

"Lots of people are doing it now because they know they need to get their offer in quickly," he said. "The market conditions are such that if you wait to see it, if it's any kind of decent deal, there are already five to 10 offers on their way, and yours will be at the back of the pack. I need to be at the front of the pack."

And while he bids blind, he never buys blind.

"The risk is limited because you have an inspection period, so there's always an opportunity to see it and walk away" if it's not up to snuff, he said.

Still, there can be surprises. He's now buying a Pleasanton condo for $279,000. When he first saw the unit - after his offer was accepted - some issues surfaced: cigarette odors, marred floors, outdated bathrooms. Since it's a short sale, in which a bank has final say, it will be difficult to negotiate the price down based on the unit needing work, he said.

But he won't walk away. "With market conditions the way they are, it's still a good value for me," he said.

Riskier deals

Some sales, such as courthouse auctions that are the final stage in the foreclosure process, don't offer a chance to see properties in advance, nor is there an inspection period. While many investors bid at those auctions, "that's much more risky to me," Livson said. "I don't like to buy without having at least a day or two to inspect it. You could have a property that looks great on the outside but has $50,000 worth of termite damage.

His agent,said she's increasingly representing investors who want to bid sight unseen for efficiency, and she has created a "buyer concierge" program in response. "We hunt the properties for them," she said.

Some agents worry that such bidders muddy the waters.

"I am concerned about buyers feeling that this is a viable option in competition," said Bebe McRae of the Grubb Co., who has sold some properties to people who bid blind. "I heard seven offers yesterday on (a property) and the deciding factor for the sellers in choosing the winner was all about the confidence they felt in the buyers being able and willing to close successfully. The buyers went to the property on several occasions and also did their inspections prior to writing the offers."

People who have made the leap of faith to bid blind - especially those planning to live in the home - said having a knowledgeable real estate agent is a big plus.

Fernando Filippelli was overseas for business reasons when a Berkeley home came on the market, in a neighborhood he knew he liked.

"I had four different friends visit the property for me. One of them is an architect," he said in an e-mail. "This, plus the fact that (my agent) provided me all types of info, made me feel comfortable to put a bid on the house."

Inspection by FaceTime

Friends and relatives thought Adam Chang and Gwen Liu were crazy when the first-time home buyers made an offer on a Kensington house while they were in Taiwan, visiting sick relatives. Chang had never seen the house in person, although Liu had.

"We did the home inspection over FaceTime, Apple's video-chatting service," Chang said. "Our agent, Mark Biggins (of Redfin), had an iPhone, I had an iPad. I could see how high the ceilings really were. If they said a floor was sloping slightly, I could get a sense that it wasn't that bad. They took me down into the crawlspace. For being halfway around the world, it was great to be able to be virtually present."

The couple returned to the United States a few days before they needed to lift the inspection contingences.

"I was able to make sure everything was copacetic; it was better than I expected," he said. "It was all about taking that leap of faith."

Source: Carolyn Said is a San Francisco Chronicle staff writer.

Study: Buyers Can Afford Bigger House If It's New

Good News on the Home Front! Ready to Buy! Let's do this together! Laura Key 310.866.8422

The National Association of Home Builders says its new study shows that home buyers can buy a more expensive, newer house and still have the same operating costs as owning an older existing home.

NAHB examined data from the Census Bureau and Department of Housing and Urban Development’s 2011 American Housing Survey to determine how utility, maintenance, property tax, and insurance costs vary depending on the age of a home.

Houses built prior to 1960 have average maintenance costs of $564 per year. On the other hand, homes built after 2008 have average maintenance costs less than half that — $241, according to the study.

For homes built prior to 1960, operating costs average nearly 5 percent of the home’s value while the average was less than 3 percent for homes built after 2008, the NAHB study found.

The study also took into account the first year after-tax cost of owning a home by its age, examining the purchase price, mortgage payments, annual operating costs, and income tax savings. “A buyer can afford to pay 23 percent more for a new house than for one built prior to 1960 and still maintain the same amount of first-year annual costs,” according to NAHB.

New houses tend to cost more than existing homes, so the mortgage payments will likely be higher — but the lower operating costs of a newer home will give buyers annual costs that could be about equal if they purchase a lower priced, older home with a smaller mortgage payment but higher operating costs, NAHB says.

"Home buyers need to look beyond the initial sales price when considering whether to buy new construction or an existing home," says NAHB Chairman Rick Judson. "They will find that with the higher costs of operating an older home, they can often afford to spend more to buy a new home and still have annual operating costs that fit their budget."

Source: National Association of Home Builders

Big Predictions for Housing for Next 2 Years

Finally some GOOD news on the Real Estate front! Regardless of what the news says...Real Estate is either UP or DOWN...either way it's a good investment! Call me to increase your worth! Laura Key 310.866.8422

Home sales are projected to post some big gains in the next two years, according to Fannie Mae’s latest monthly economic outlook.

Fannie Mae economists predict that existing-home sales will rise by 10.5 percent this year, and by 6.2 percent in 2014. The economists made even bolder projections for new single-family home sales -- growing 15.1 percent this year and 44.1 percent in 2014.

"We expect home prices to firm further amid a durable housing recovery, continuing to boost household net worth, gradually diminishing the population of underwater borrowers, and reducing incentive for strategic defaults," according to Fannie Mae’s report.

Fannie Mae projects that mortgage rates will stay low by historical averages this year, but the 30-year fixed-rate mortgage will rise from an average of 3.5 percent during the first quarter to an average of 4 percent during the final three months of 2013. During the fourth quarter of 2014, mortgage rates are projected to tick up to a 4.5 percent average.

Mortgage applications for purchases are projected to increase by 16.8 percent this year and by 17.1 percent in 2014. However, a decline in applications for refinancings will likely cause mortgage originations to be down 14.5 percent this year and by 31.4 percent in 2014, Fannie economists predict.

Source: “Fannie Mae sees housing upturn as 'intact',” Inman News (March 28, 2013)

Come "like" my Facebook Fanpage! www.Facebook.com/RealtyGoddess

How to Assess the Real Cost of a Fixer-Upper House

When you buy a fixer-upper house, you can save a ton of money, or get yourself in a financial fix. People see shows on television and think it's easy to purchase a home that needs fixing. Know what you are getting into before you put the money down on the table! Call me with your questions Laura Key 310.866.8422

1. Decide what you can do yourself

TV remodeling shows make home improvement work look like a snap. In the real world, attempting a difficult remodeling job that you don’t know how to do will take longer than you think and can lead to less-than-professional results that won’t increase the value of your fixer-upper house.

- Do you really have the skills to do it? Some tasks, like stripping wallpaper and painting, are relatively easy. Others, like electrical work, can be dangerous when done by amateurs.

- Do you really have the time and desire to do it? Can you take time off work to renovate your fixer-upper house? If not, will you be stressed out by living in a work zone for months while you complete projects on the weekends?

2. Price the cost of repairs and remodeling before you make an offer

- Get your contractor into the house to do a walk-through, so he can give you a written cost estimate on the tasks he’s going to do.

- If you’re doing the work yourself, price the supplies.

- Either way, tack on 10% to 20% to cover unforeseen problems that often arise with a fixer-upper house.

3. Check permit costs

- Ask local officials if the work you’re going to do requires a permit and how much that permit costs. Doing work without a permit may save money, but it'll cause problems when you resell your home.

- Decide if you want to get the permits yourself or have the contractor arrange for them. Getting permits can be time-consuming and frustrating. Inspectors may force you to do additional work, or change the way you want to do a project, before they give you the permit.

- Factor the time and aggravation of permits into your plans.

4. Doublecheck pricing on structural work

If your fixer-upper home needs major structural work, hire a structural engineer for $500 to $700 to inspect the home before you put in an offer so you can be confident you’ve uncovered and conservatively budgeted for the full extent of the problems.

Get written estimates for repairs before you commit to buying a home with structural issues.

Don't purchase a home that needs major structural work unless:

- You’re getting it at a steep discount

- You’re sure you’ve uncovered the extent of the problem

- You know the problem can be fixed

- You have a binding written estimate for the repairs

5. Check the cost of financing

Be sure you have enough money for a downpayment, closing costs, and repairs without draining your savings.

If you’re planning to fund the repairs with a home equity or home improvement loan:

- Get yourself pre-approved for both loans before you make an offer.

- Make the deal contingent on getting both the purchase money loan and the renovation money loan, so you’re not forced to close the sale when you have no loan to fix the house.

- Consider the Federal Housing Administration’s Section 203(k) program, which is designed to help home owners who are purchasing or refinancing a home that needs rehabilitation. The program wraps the purchase/refinance and rehabilitation costs into a single mortgage. To qualify for the loan, the total value of the property must fall within the FHA mortgage limit for your area, as with other FHA loans. A streamlined 203(k) program provides an additional amount for rehabilitation, up to $35,000, on top of an existing mortgage. It’s a simpler process than obtaining the standard 203(k).

6. Calculate your fair purchase offer

Take the fair market value of the property (what it would be worth if it were in good condition and remodeled to current tastes) and subtract the upgrade and repair costs.

For example: Your target fixer-upper house has a 1960s kitchen, metallic wallpaper, shag carpet, and high levels of radon in the basement.

Your comparison house, in the same subdivision, sold last month for $200,000. That house had a newer kitchen, no wallpaper, was recently recarpeted, and has a radon mitigation system in its basement.

The cost to remodel the kitchen, remove the wallpaper, carpet the house, and put in a radon mitigation system is $40,000. Your bid for the house should be $160,000.

Ask your real estate agent if it’s a good idea to share your cost estimates with the sellers, to prove your offer is fair.

7. Include inspection contingencies in your offer

Don’t rely on your friends or your contractor to eyeball your fixer-upper house. Hire pros to do common inspections like:

- Home inspection. This is key in a fixer-upper assessment. The home inspector will uncover hidden issues in need of replacement or repair. You may know you want to replace those 1970s kitchen cabinets, but the home inspector has a meter that will detect the water leak behind them.

- Radon, mold, lead-based paint

- Septic and well

- Pest

Most home inspection contingencies let you go back to the sellers and ask them to do the repairs, or give you cash at closing to pay for the repairs. The seller can also opt to simply back out of the deal, as can you, if the inspection turns up something you don’t want to deal with.

If that happens, this isn’t the right fixer-upper house for you. Go back to the top of this list and start again.

Source: www.houselogic.com - G.M. Filisko is an attorney and award-winning writer whose parents bought and renovated a fixer-upper when she was a teen. A regular contributor to many national publications including Bankrate.com, REALTOR® Magazine, and the American Bar Association Journal, she specializes in real estate, business, personal finance, and legal topics.

Fast California Real Estate Stats

The market has changed! What does this mean to you as a buyer or a seller? Ask me! Laura.A.Key@gmail.com or 310.866.8422

- Calif. median home price: January 2013: $337,040 (Source: C.A.R.)

- Calif. highest median home price by region/county January 2013: Marin, $799,110 (Source: C.A.R.)

- Calif. lowest median home price by region/county January 2013: Madera, $98,330 (Source: C.A.R.)

- Calif. Pending Home Sales Index: December 2012: 82.3 , down 20.5 percent from November's 103.5.

- Calif. Traditional Housing Affordability Index: Fourth quarter 2012: 48 percent (Source: C.A.R.)

- Mortgage rates: Week ending 3/7/2013 30-yr. fixed: 3.52% fees/points: 0.7% 15-yr. fixed: 2.76% fees/points: 0.7% 1-yr. adjustable: 2.63% Fees/points: 0.3% (Source: Freddie Mac)

Waste Not...Want Not

Americans have a global reputation for eating vast quantities of food. As a result, there are more overweight people in the U.S. than anywhere in the world. Now it looks like U.S. consumers can add an equally embarrassing reputation for throwing out more food than anyone else. According to a study produced by the Natural Resources Defense Council, a non-profit, international environmental advocacy group, as much as forty percent of food in the United States is never eaten.

That amounts to $165 billion a year in waste, or 20 pounds of food annually for every man, woman and child in the US. Think of it as dumping 80 quarter-pound hamburger patties in the garbage each month.

Americans waste 10 times more food than Asian countries and American waste is up 50% since the 1970s.

Most of the waste occurs in the home. American families throw out approximately 25% of all the food and beverages they buy. Food is so cheap and plentiful in the United States that Americans just don't value it properly. Impulse buys, sales, and incentives to buy in bulk are some of the reasons why Americans buy more food than they can eat.

Part of the problem comes from spontaneous decisions to eat out when there's still food in the fridge. And when Americans do cook at home, they make far more than they can consume. The average size of the U.S. dinner plate is 36% bigger now than it was in 1960.

Portion sizes account for significant food loss in restaurants, too. Seventeen percent of the food served in restaurants is not eaten. Portion sizes can be up to eight times larger than USDA or FDA standard serving sizes. Particularly wasteful are restaurants that serve buffets, because health code restrictions restrict buffet food from being reused or donated.

Among the biggest wasters of food are food retailers. They overstock displays of fresh produce to give an impression of bounty, leaving items at the bottom bruised and not fit to sell. They make too much ready-to-eat food so as much as 50% gets thrown out. And they throw out food in damaged or outdated promotional package that is still edible.

There is also a problem on farms. Approximately 7% of planted fields in the United States are not harvested each year. Growers either can't get a good enough price for their crop to make harvest profitable, or they over-planted and have more crop than there is demand for. Citrus, fruit, and grape packers estimate that as much as 20% to 50% of the food they produce never gets marketed.

Although the economic figures are staggering, the unnecessary high toll on natural resources and environmental implications are more worrisome. Food production accounts for 80% of the country's fresh water consumption. A single hamburger takes 660 gallons of water to produce. Wasted food means that 25% of that fresh water is being wasted.

Food waste also contributes to global warming. Experts say that food rotting in landfills accounts for 25% of U.S. methane emissions. Methane is a greenhouse gas that remains in the atmosphere as long as 15 years and is 20 times more effective at trapping heat than carbon dioxide.

Food labels are culprits, too. Consumers often confuse "sell-by" dates with "use-by" dates. On average, grocery stores throw out nearly $2,500 worth of food each day because the products have neared their sell-by expiration date. Yet most of this food is still perfectly edible.

In many states, it's legal to sell food past its expiration date but many stores do not because they think it looks bad. Most stores, in fact, pull items 2 to 3 days before the sell-by date

An unfortunate truth of all this is that the more food consumers waste, the more those in the food industry are able to sell. This is true throughout the supply chain where waste downstream translates to higher sales for anyone upstream. That needs to change.

In a generation, some nine billion people will be living in a world where the increasing scarcity of natural resources and environmental dynamics more and more affect individuals and society. A prodigious waste of food is simply not a sensible option in a desirable future.

The fact of the matter is that the world now produces enough food to feed everyone in the world, yet one in every six people goes hungry. If Americans could reduce food waste by just 15%, it could feed more than 25 million of the 50 million Americans who go hungry each year.

Source: Good Neighbor Newsletter - Feb 2013

Laura Key, Real Estate Agent - 310.866.8422 - Laura.A.Key@gmail.com