BLOG

10 Things Everyone Assumes About Real Estate Agents That Aren’t True

Let’s face it, everyone either knows a real estate agent, or is connected to one through six (probably less) degrees of separation. Between friends and relatives, and the stereotypical representation of real estate agents on television and in pop culture, the general public has a adopted some assumptions about agents that are very far from the truth.

Here are ten things that people assume about real estate agents that just aren’t true:

1. They make “easy money”

HAHAHAHAHAHAHAHAHAH. The only people who could ever possibly make the case that being an agent is an easy way to make money are those who have never done it. It’s hard, uncertain work, with many instances of months wasted on a deal that doesn’t ever close. The only thing easy about it is reading the Lighter Side of Real Estate.

2. They are required to show you houses even if you’re not pre-approved

There are definitely agents who will show you houses without a pre-approval (or at minimum a pre-qualification), but an agent is not required to, and most experienced agents probably won’t. The ability to qualify for financing dictates whether or not a deal is even possible, so an agent is simply saving you from disappointment (or worse) by asking you to get pre-approved.

3. Zillow is more accurate than they are

It would be wonderful if Zillow (and similar websites) were accurate in their home valuations, but if you compared their results to actual appraised values, in most cases you’d burst out laughing. Real estate agents want you to get as much money as possible for your house, but oftentimes reality gets in the way. Trust your realtor to give you a fair market assessment for your house…at least more than you trust Zillow.

4. They make huge commissions

The popular real estate flipping shows on cable, and Million Dollar Listing have given everyone the impression that real estate agents are rolling in the dough. Most real estate agents wish that this was true, but reality is much different. The median US existing home sale price in December 2016 was $234,900, which means after splitting the commission and paying their broker, an agent took home about $3500 on the transaction, not including all marketing and related expenses. As a monthly income, this adds up to about $40,000 per year. Not exactly huge.

5. They’re an unnecessary evil

Many people have made the argument that real estate agents are unnecessary and are merely an impediment to a more efficient “For sale by owner” model of real estate. The best way to eliminate this misconception is to try selling your house yourself. There is nothing more sobering than desperately Googling state and federal real estate laws as some unkempt stranger is knocking on your door asking you questions about your FSBO house.

6. They’re sleazy

Unfortunately, real estate agents have joined the ranks of lawyers, politicians, and salespeople in some of the public’s assumptions about their trustworthiness. The financial collapse of 2008 exacerbated this perception. Thankfully, the market correction also weeded out most of the unsavory elements in the business. The truth is, real estate agents are honest, hardworking people, making a living like any other profession. And just like any other profession, there are a few bad apples that unfairly give the others a bad name.

7. They’re uneducated

This misconception really gets under most agents’ skin, because not only do many agents have degrees (and advanced degrees in quite a few cases), but the knowledge required to pass a real estate exam is substantial. There are many people who are unable to get their licensing because of an inability to pass the licensing tests, which makes the concept of an “uneducated” agent laughable.

8. They want you to pay more for a house so they can make more money

If you truly looked at the math involved in calculating real estate commissions, you’d never utter this falsehood again. An agent getting you to pay $10,000 more for a property will net that agent approximately $150, which barely covers the cost of gas required to drive to and from your appointments. The truth is that an agent absolutely wants you to buy a house. What’s not true is that they want you to pay more for one.

9. They’re mostly part-timers or bored housewives

If you ask the average person to describe the archetypal real estate agent, they’ll probably say it’s an older married woman who is looking for something to do in her free time. Ugh. This is stereotyping at its finest, and ignores the hundreds of thousands of male agents, the hundreds of thousands of full-time agents, and the hard-working primary bread winners that make up the real estate workforce. Sure, the stereotypical agents do exist, but they’re the exception to the rule.

10. All they want from you is the deal

Yes, agents want your business. But true professional real estate agents want to be your lifelong real estate advisor. They want you to think of them whenever you or your family and friends have any real estate questions. They want to see you and talk to you more than once a decade, and they want to make sure that you remember your interactions with them as being absolutely delightful.

What Affects Property Values

Some the features that increase property values are obvious-like a remodeled bathroom, a modern kitchen, or a sought-after neighborhood. But here are a few features and circumstances you have not have realized can affect property values.

- The neighbors: Not every neighborhood or community has an HOA that can keep the neighbors from going overboard with decorations or neglecting to care for their home. Homes adjacent to crazy neighbors can potentially be undervalued.

- Trendy groceries and coffee: Recent statistics suggest that if your home is a short walk from popular grocery stores like Whole Foods or coffee chains like Starbucks, it can actually appreciate faster than the national average.

- Mature trees: A big beautiful tree in the front yard is enviable, and it's not something that can be easily added to any home. Homes with mature trees tend to get a little boost in value.

- Parking: This isn't too much of an issue if you live in the suburbs or in a rural area, but residents in dense cities can have real problems with parking, and homeowners might need to rent a spot just to guarantee a place to park each night. That's why having guaranteed parking in urban areas will raise property values.

- The front entrance: First impressions matter to buyers-many will cross a home off their list within 10 seconds of stepping through the front door. An appealing front door, a friendly entryway, and a functioning doorbell are all necessities for getting top dollar.

Reconsider These Choices When You're Designing Your Kitchen

The kitchen is one area of the home that sees the most wear and tear. All the water, heat, and food spills add up quickly so it’s important to focus on quality and lasting appeal when you’re choosing materials for a kitchen remodel. Here are a few things you should avoid:

Cheap Laminate Countertops: The bottom rung of laminate is extremely susceptible to wear and tear. It can melt if you forget to place a hot pad under a pan that’s fresh out of the oven and the edges can chip off from repeated exposure to moisture and heat.

Flat Paint: A flat or matte finish is great in rooms with lower traffic, but it’s a bad idea in the kitchen where the walls are regularly exposed to splatters and spills. You need paint that can withstand an occasional heavy scrubbing, so opt for gloss or semi-gloss finishes. Hire a local painter to make sure the job is done properly.

Trendy Backsplash: If you watch any home remodeling show, you’ll certainly see kitchens with expensive, elaborate backsplash designs and materials. Those trends can be pricey to pursue and can look dated in a hurry. Subway tile is a cheaper, classic option that you’ll never regret, plus you’ll have more room in your budget to purchase quality materials to be used elsewhere.

Cheap Flooring: Just like the countertops, your kitchen floor needs to be strong enough to take some abuse. Cheap flooring easily scuffs and peels (especially from moisture). Quality flooring is worth the investment.

Hidden Homeowner Costs

Budgeting for buying a home can be difficult enough when you're just weighing mortgage options and a purchase price. But there are many other factors that go into the cost of home ownership. Some of them are one-time expenses that you'll pay during the home buying process, while others will be recurring costs for as long as you own the home.

Closing costs

There are several smaller fees that add up to a rather large sum when you're going through the closing process-loan fees, attorney fees, underwriting fees, and more. They typically add up to 2-5% of the purchase price. For a $300,000 home-roughly the national median-that's in the neighborhood of $10,000, so be sure to budget for it.

Appraisal

Your lender will require an appraisal, and the appraisal fee (a few hundred dollars) comes out of your pocket. Inspection

The few hundred dollars you'll pay for a home inspection is money well spent, but it's something you have to keep in mind during the purchase process. You'll have the peace of mind of knowing the house is free from any major issues, and you're making a smart, solid investment.

Insurance

Although homeowners insurance isn't legally required, it'll almost certainly be required by your lender. Further insurance, such as flood insurance, may also be required (depending on your location).

Home Owners Association

If you're living in a property or community with shared spaces, you'll almost certainly have an HOA fee. This pays for things like trash removal, maintenance of common areas, and for recreational facilities like gyms and swimming pools.

Good Neighbor Next Door - HUD Program

Did you know there is a program out there especially for Law Enforcement, Firefighters, EMTs and Teachers?

It is called the Good Neighbor Next Door Program and it is through HUD. This program is not widely known about. The homes are not always available, but when they do come up it is a wonderful way to become a homeowner with benefits.

There are special requirements to qualify for this program, but if you do and you win one of these homes...you would get it for HALF off.

Please watch my Periscope video to learn more and if you would like to sign up for my free GNND Course, please do so here!

bit.ly/gnndhouse

Advice For Buyer's In A Seller Market

The market is crazy hot right now! How can you as a buyer in a seller's market reach the goal of homeownership?

With the high demand and low inventory, what can a buyer do to make sure they're getting the best price possible. How can they best compete with other offers?

The first thing buyers need to understand is they MUST NOT get over emotional. With so many people feeling desperate to obtain a home they are willing to offer well over asking on homes. I have seen homes go $60,000 over asking price, only to hit a major bump when it came to appraisal. Be patient, be wise. Have your agent run comps for the area before putting an offer in on a home and be comfortable if you are not the highest bidder at the time. I have closed a lot of "backup" deals because the first accepted offer did not close. Patience is key, if you are in RUSH at this time then it may not be time for you to purchase.

Do you foresee the current housing inventory issue lasting throughout the near future? In your opinion what circumstances would need to change to get the market out of this inventory crisis?

Unfortunately, I feel this market is going to continue to rise and buyers will be shut out with the current pricing trend. I believe SELLERS need to be more educated about putting their homes on the market. They need to understand that the "highest and best" offer is not always the best offer. In order for this market to change, sellers will have to see that buyers can no longer afford. Once that happens the offers will stop coming in and prices will be forced to drop in order for the buyers to afford the home of their dreams. At some point, the market is going to break and until money is not flowing it won't change.

How has the business of your real estate partners been affected? Are they doing anything different to combat it?

Deeper business relationships are happening. It is critical that all involved are on the same page. This includes Realtors, Lenders, Title Reps, Escrow professionals and even vendors. When all pieces of the puzzle are present it creates a unified front all with a single goal in mind to assist the buyers and sellers.

What steps would you advise a potential homebuyer to take when buying in this current market?

Patience and strategy! These two elements are a MUST. If you qualify for $400,000 then you must look at homes that are at least $15,000 to $25,000 under that asking price. This gives you room to play without going over your budget and pre-approval. Do not let emotions get the best of you. Bidding wars cause people to "lose their minds" and this could cause many problems down the line with the deal and with buyers remorse. Never buy ABOVE your means. What use is it to have a home if you can't afford it? You want your home to be a place of peace and wonderful memories.

What The Heck Is A Short Sale

Please note, this transcript is an abbreviated version of the video.

Hello Hello Hello my loves this is Laura Key, I am the Realty Goddess of Los Angeles California. I help "Establish the Community One House At A Time" and I have been in the business for 11 years. I started my career in Colorado and now I am in Los Angeles. I have been in Los Angeles for about six years now and I was a Realtor in Colorado for five years. I love me some Denver. Denver is actually going through a big boom right now as well as Los Angeles.

What the heck is a short-sale? You see them listed on the MLS sometimes and you hear that you can grab a bargain if you purchase one. Today we will discuss these issues and educate you on how these types of sales are processed.

The first thing to learn about a short-sale is that there is nothing short about a short-sale! What is actually short, is what the owner currently owes the bank compared to what the current market value is. If the home is upside down or less than what the current owner paid then the owner has to ask permission from the bank to sell the home at a loss. There are many different reasons that people have to do a short-sale but it's typically centered around a hardship. Maybe the owner lost a job, lost a spouse, has to relocate for a job or has become ill and can no longer afford the home.

Let's take a quick look at what a short-sale is and how it is processed so you can get a better understanding as a buyer so you can decide if you want to go for them as a purchase OR have a better understanding if you are in the seller role.

The number #1 rule is worth repeating...There is nothing short about a short-sale.

The first thing you want to do if you are the owner and have found yourself in a financial bind and you need to sell your home but you cannot pay off the full mortgage, you must contact your financial institution immediately. Let them know the situation and tell them you are interested in doing a short-sale. The majority of financial institutions have short-sale packets ready for you to fill out. The more pro-active you are the more chance you will have in selling your home as a short-sale. These packets can be very tedious and frustrating because it's a lot of paperwork and a lot of writing.

Here is typically what you are going to be asked for: two years worth of taxes, a hardship letter that explains why you need to sell, 3-6 months of pay stubs, 3-6 months of bank statements. If you don't have any of these items, you must write a note as to why you do not have theses items. Simply saying "I don't have them" will not work. Write it out and put it in the packet. Your hardship letter needs to explain exactly why you are having a hardship. Keep it simple and to the point, there is no need to write a book. My advice is to have all of these items completed BEFORE you list the home. Your real estate professional can help guide you on this.

Your home will be marketed just like a regular home for sale. We will have open houses, we will advertise, we will have showings. Once that has been completed and we have an offer or offers, we choose the best offer to accept then prepare to present it to the bank. I must stress that a COMPLETE short-sale packet must be sent to your bank or it can cause problems. It will be the ultimate decision of the bank if they will accept the offer or not. Most likely they will respond to what "their" terms will be for any potential buyer. It takes about 45 to 120 days for a short-sale to be completely processed.

To the buyer, short-sales are not always easy, you are going to have to be patient. If you like that house and you want that home then you must be patient while this process is going on. Unfortunately, an agent is not going to be able to update you daily, but a good agent knows that they must talk to the bank at least twice a week to keep the short-sale moving smoothly. I typically give all parties an update once or twice a week as I get them.

Are short-sales always a good deal?

Some are and some are not. It also depends on the market itself. We are in a seller's market (May 2017) and this means inventory is low so ALL homes are being considered by many buyers. You will find multiple offers even on distressed sales. Sometimes being a backup offer on a short-sale can benefit you because nine times out of ten the writer of the original winning offer is no longer interested.

How does a short-sale affect your credit as a seller?

Short-sales are not as bad as a foreclosure on your credit. If you keep your credit clean after your short-sale, you may be able to buy again after two years. Short-sales are reported on your credit. It will affect your credit score.

I always advise if you are in trouble with your payments, please contact your financial institution as soon as possible and inquire if a short-sale is for you. In the long run it's going to be better for you and your future home buying.

For more information about short-sales or any other real estate topic please reach out to me and I will help assist you!

5 Great Ways To Research Your Neighborhood

Whether you are buying or selling, it is best to know all you can about your neighborhood. Crime, school and events affect the values of your home.

These great sites will help you keep on top of what is going on around you and will help educate you about what is going on in your neighborhood!

In the words of "Mister Rogers" Won't You Be My Neighbor?

Of course, it may also help if you have an idea of things to do in the area!

Understand Before Signing Contracts

Real Estate contracts are legally binding! Make sure you are able to read and understand them BEFORE you sign or are ready to proceed with buying or selling!

Ask for a copy of the contracts ahead of time so you have plenty of time to sit and discuss them with your agent!

I give my clients copy of them before we begin, then we have a sit down and discuss them!

Real Estate is a huge transaction, isn't it worth your time to know what you are putting the pen to paper?

What The Heck Is FIRPTA?

HOW DOES THIS WORK?

Withholding of Tax on Dispositions of United States Real Property Interests. The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding.

For More Info From the Experts! Contact...

Nena Mahlum

FIRPTA Supervisor

Harding Bell International, Inc.

Foreign & Domestic Investment Tax & Accounting Specialists

8687 W. Irlo Bronson Hwy. (192), Suite 206

Kissimmee, Florida. 34747, USA

113 Pontotoc Plaza

Auburndale, Florida. 33823-3439, USA

230 East Park Avenue, Suite 41

Lake Wales, Florida. 33859 USA

Tel: 001 863 968 1010

Fax: 001 863 968 1020

Personal email: nena.mahlum@HBItax.com

General email: info@HBItax.com

Website: www.HBItax.com

Credit Chat - Get Over Your Fears

When you mention the word "credit" most people shutter! But knowing the facts can help you conquer the fear and get on the path to homeownership!

Join Laura Key, Realtor and Sondra Meadows, Mortgage Loan Expert to get the scoop on credit and how you can fix the most common issues and get on the path to buying a new house or car!

To Reach Laura: laura@laurakey.net

To Reach Sondra: bit.ly/sondrameadows2

Painting Your Own Home: Tips to Make the Process Painless

Painting Your Own Home: Tips to Make the Process Painless

While it’s might seem easier to hire professionals to paint the house, but with a little research you can find the job is not as intimidating as it seems. With a few free days set aside and some preparation, painting one room (or multiple) is easily doable for anyone. Here are a few things to consider before you start.

Apply a Primer Coat

Preparation entails most of the painting process. It’s easy to become frustrated during the preparation stage, because prepping to paint can take longer than the actual painting component of the project.

Interior walls aren’t always perfect, and painting the walls is a perfect opportunity to fix those imperfections. If you’re using a putty or a filler to patch holes, the paint will react differently to those substances than it will the wall itself. The solution here is to prime your walls, so the new paint color has a uniform surface to adhere to. It’s one simple step that doesn’t seem like much, but could end up saving you a whole lot of work at the end of the process.

Factor in taping time

Taping up the room is tedious work, but will be worth it when you don’t have to waste time being ultra-careful or nervous when getting close to edges. Instead of trying to take the tape off while the paint is still dry, wait at least 24 hours for the paint to dry, and use a knife to slice the tape off at the edge. If the paint is still even a little wet or gummy, don’t continue. Make sure the knife is sharp enough and pull the tape away at a 45-degree angle, making sure not to rip the paint.

Set up with clean-up in mind

To protect floors, a drop cloth is a necessity. In some cases, cotton or canvas drop clothes can work better than plastic. Plastic drop cloths can be slippery and don’t easily stay in place, especially when ladders are involved. Any splatters or drips of paint that fall onto a plastic drop cloth won’t dry or absorb right away and can be easily tracked throughout the rest of your house. A canvas or cotton drop cloth will be more stable and will protect the floors better. Tape the edges of the drop cloth to the tops of the trim to protect both the floor and the trims from any splattering or dripping paint.

Work top down

Not only does it prevent drips from ruining anything you’ve already painted, but it keeps the walls and baseboards free of any dust or debris from sticking to wet trim. Paint the ceiling first, move to the walls and possible crown moldings. Only then should you move to any trims around windows or doors and finish with the baseboards. Not only will this keep a system in place to ensure there’s no questioning what’s been painted and what hasn’t, but it’ll keep things clean.

Check thickness of previous paint layers

Cracks on an exterior paint job don’t reflect the owner’s best intentions and should be fixed before the damage is too much to fix. Too thick of a layer of paint means that the paint might just be too heavy to stay, and will start to crack and to peel off. It loses its grip and can’t attach to the other layers of paint. In older homes, it’s likely that some of those layers of paint have lead in them, in which case you’ll need to look into how to remove it safely. The EPA has guidelines here. This could be the one step that requires you to outsource, if the layer of paint is extremely thick, because removing it completely (and correctly) will ensure the next coat of paint will attach correctly. Hiring a home washing company can help you identify these cracks in exterior paint as well. If anything, have the exterior of your home professionally power washed, so the paint will have a clean surface to adhere to.

Using these tips, ideally the house-painting process will be doable for anyone. Prepare yourself to set aside time for set-up, knowing that it will help when you’re done painting and ready to clean up. Instead of hiring painting professionals, save some money for decorating and tackle the job yourself.

Curious to know how much your Southern California home is worth! Get an instant report now! www.CaliOnTheMove.com

Bio: Matt Lawler is an Internet marketing specialist from Tempe, Arizona where he attended Arizona State University. Whenever he can step away from the computer, Matt enjoys playing sports, traveling and exploring the great outdoors. Follow him on Twitter.

Laura Key, REALTOR® Cal BRE 01908085 310-866-8422 Laura.A.Key@gmail.com www.KeyCaliforniaHomes.com

Types of Real Estate Sales - Coffee Time with the Realty Goddess

https://youtu.be/swxL643JKYw

When you are purchasing a home you will come across many different "types" of sales. Short-Sales, Stand, HUD, Trust, REO...it can be confusing. This broadcast will look into the terms and untangle the mystery.

If you are in the Los Angeles area, I would love the opportunity to earn your business.

Laura Key, REALTOR Cal BRE 01908085 Laura.A.Key@gmail.com www.KeyCaliforniaHomes.com

Follow me on: Periscope & Twitter: @RealtyGoddess Snapchat: @RealtyGoddess Instagram: @realtygoddess1 Facebook: www.Facebook.com/RealtyGoddess

How To Find A Realtor (Buyer)

[youtube https://www.youtube.com/watch?v=Hf7vgVU_IGs&w=420&h=315] Did you know most people choose a Realtor by spinning the wheel of fortune? When you are buying a home, you really should take the time to interview agents to help your buying experience the most enjoyable as it can be.

Did you know not all agents work the same? Some don't work weekends, some don't want to work with buyers, some only work certain hours of the day, some are part time, etc. But how will this benefit you when you are working hard to find the home of your dreams.

Interviewing agents is a extremely important part of successfully buying a home.

Enjoy the above Periscope broadcast to learn a few things when choosing a Realtor! (recorded March 19, 2016)

Please note I have a correction: If an agent tells you they will not let you out of a buyer's agency, please think long and hard before signing.

Follow me...

Snapchat: @realtygoddess Periscope & Twitter: @realtygoddess Instagram: realtygoddess1 Facebook: www.Facebook.com/RealtyGoddess Website: www.KeyCaliforniaHomes.com

The “KEY” to your real estate dreams!

Lots of Los Angeles Real Estate Agents want to be stars as big as the celebrities they cater to. Me? I just want to help people find the homes that make them happy and help them to create a sanctuary for future dreams and lasting memories.

Laura Key 310-866-8422 Laura.A.Key@gmail.com Cal BRE #01908085

Why It Is Important to Be Pre-Approved before Looking at Homes

[youtube https://www.youtube.com/watch?v=c5Yj5U7iRt8&w=420&h=315] One of the first things you have to do before buying a home is to find out how much you can afford! It is a critical step to home ownership. Believe it or not, one of the I hear most is how "afraid" people are of this step. Honestly, there is no need to fear.

Enjoy this post about the process and call me if you have questions!

Follow me on.... Perioscope & Twitter: @realtygoddess Instagram: realtygoddess1 Facebook: www.Facebook.com/RealtyGoddess

10 Commandments When Buying A Home

When you are buying a home there are some things you must know to make the transaction smooth. These 10 Commandments will help start you on the right track.

[youtube https://www.youtube.com/watch?v=5OLBQETJ3u8]

- Thou Shall Not Change Jobs or become Self Employed or Quit Your Job

- Though Shall Not Buy a Car, Truck, or Van (this also includes boats)! You may be living in it.

- Thou Shall Not Use Credit Cards Excessively

- Thou Shall Not Spend Money Set Aside For Closing

- Thou Shall Not Omit Debts or Liabilities in your Loan Application

- Thou Shall Not Buy Furniture on Credit

- Thou Shall Not Originate ANY Inquires on your Credit

- Thou Shall Not Make Large Deposits without Checking With Your Loan Officer

- Thou Shall Not Change Bank Accounts

- Thou Shall Not C0-Sign for ANYONE

Find out more great tips and tidbits by following me on...

Twitter & Periscope: @realtygoddess Instagram: realtygoddess1 Facebook: www.Facebook.com/RealtyGoddess

Happier Hardwood Floors

Hardwood floors make for a beautiful, stunning addition to your home. However, they can bring new cleaning and maintenance challenges that aren’t present with carpet. Here are some tips for simple, efficient, and thorough hardwood floor cleaning.

Make the job easier Place mats on either side of your exterior doors and always remove your shoes before entering your home—and make sure your guests do the same. Protect the floors by placing felt (or similar) protectors on the feet of your furniture, and use area rugs to designate play areas for the kids. This will reduce extra dirt, dust, and floor scratches.

Weekly cleaning Sweeping with a standard broom will remove some dirt and dust, but not as much as a mop, wipe, or broom that’s been treated with a dusting agent such as a Swiffer. You could also invest in a vacuum that is designed for hardwood floors. Just be sure that the vacuum won’t leave scratches!

Deeper cleaning Regular sweeping will remove most dirt and dust, but occasionally you’ll need to give the floors a deeper cleaning to remove the dirt and grime that builds up in your floors’ seams. Use a wood-cleaning soap to thoroughly mop your floors, but make sure the mop isn’t sopping wet—you don’t want to leave standing water.

Spots and scuffs Most of the marks that occasionally show up on your floors, such as scuffs from rubber soles on boots and shoes—can be wiped away with a rag or very fine steel wool.

To find your next home: www.KeyCaliforniaHomes.com To find the value of your current home: www.CaliOnTheMove.com

The "KEY" to your real estate dreams!

Lots of Los Angeles Real Estate Agents want to be stars as big as the celebrities they cater to. Me? I just want to help people find the homes that make them happy and help them to create a sanctuary for future dreams and lasting memories.

Laura Key 310-866-8422 Laura.A.Key@gmail.com Cal BRE #01908085

Los Angeles FHA Loan Limits

Homeownership is not out of reach. FHA limits in California are one of the highest in the country. I have great lenders that can help you reach your real estate goals! Call me to get started on your home ownership goals!!! Laura Key 310.866.8422

Here are the current limits for Los Angeles (as of Nov 13, 2014) FHA allows 3.5% downpayment over a 15 to 30 year term!

Single Family $625,500

Duplex $800,775

Tri-Plex $967,950

Four-Plex $1,202,925

Start your home search today!

**Source: https://entp.hud.gov

Unexpected Benefits of Repainting Your Home

Unexpected Benefits of Repainting Your Home

Unexpected Benefits of Repainting Your Home

As a homeowner, you understand the importance of updating your property from time to time. Whether you plan on putting your house on the market or are ready to embark on a home improvement project, repainting your home both inside and out is a great way to personalize your living space while also adding value to your home. Read on to discover 5 unexpected benefits that accompany a fresh paint job!

Cleanliness

The first benefit that comes along with a newly painted interior is a dramatically cleaner house. Over time, interior walls get scuffed, scraped and smudged and often times we don’t even notice. Highly trafficked walkways receive the majority of this damage, but doorways and walls near furniture often find themselves in danger as well. Recently painted walls also take some of the age out of the appearance of your home, and anyone who visits will take notice of how new your home feels.

Cost Effectiveness

When considering potential home improvement projects, there are few options that provide as much benefit as a new paint job in the same price range. Other common ventures such as remodeling a kitchen or bathroom can cost thousands of dollars between the work, materials, and appliances necessary to complete them. Renewing interior wall paint can be done by the homeowner with the only cost being painting materials, and hiring a local house painter would still be cheaper then other home renovation undertakings.

Air Quality

Thinking about the cleanliness of the air within your home should be a top priority, and recently painters have become more aware of the effect that their paint has on home environments. This had led to an increase of paints that contain little or no amounts of ‘Volatile Organic Compounds,’ which are carbon-based chemicals that can easily evaporate at room temperature. These compounds, known as VOC’s, are known by the Environmental Protection Agency (EPA) to cause eye, nose and throat irritation, frequent headaches, nausea, and can also damage the liver, kidney and central nervous system. If you live in an older home or you are not sure about the level of these compounds in your current paint, it is imperative that you repaint your interior for your own health.

Environmental Protection

Having a fresh coat of paint on the exterior of your abode is nearly as beneficial as updating the paint on your interior. The first and most obvious reason that exterior house painting is advantageous is the boost in curb appeal. Whether your house will be listed for sale or not, visitors and passerby will notice the improved aesthetic of your external walls. Beyond just impressing the people who see your home, refreshing the paint on the outside of your house will also protect your building materials. High-quality paint on the exterior of your home will decrease the risks imposed by inclement weather conditions. Repainting the exterior of your home will simultaneously improve the look of your house and save you money by preventing expensive repairs!

Increased Home Value

The final, and most obvious, improvement that comes from repainting your home is the bump that your property receives in value. I have already discussed the boost in curb appeal and that fresh paint makes a home feel newer, which are both reasons why your home’s worth will increase. Most realtors advise against starting large renovation projects prior to listing your house for sale out of fear that you will not see a return on your investment, but the low cost associated with a repainted home makes this a safe bet to provide tremendous return on investment.

Curious to know how much your Southern California home is worth! Get an instant report now! www.CaliOnTheMove.com

Bio: Matt Lawler is an Internet marketing specialist from Tempe, Arizona where he attended Arizona State University. Whenever he can step away from the computer, Matt enjoys playing sports, traveling and exploring the great outdoors. Follow him on Twitter.

Laura Key, REALTOR®

Cal BRE 01908085

310-866-8422

Laura.A.Key@gmail.com

Auto Insurance Shopping

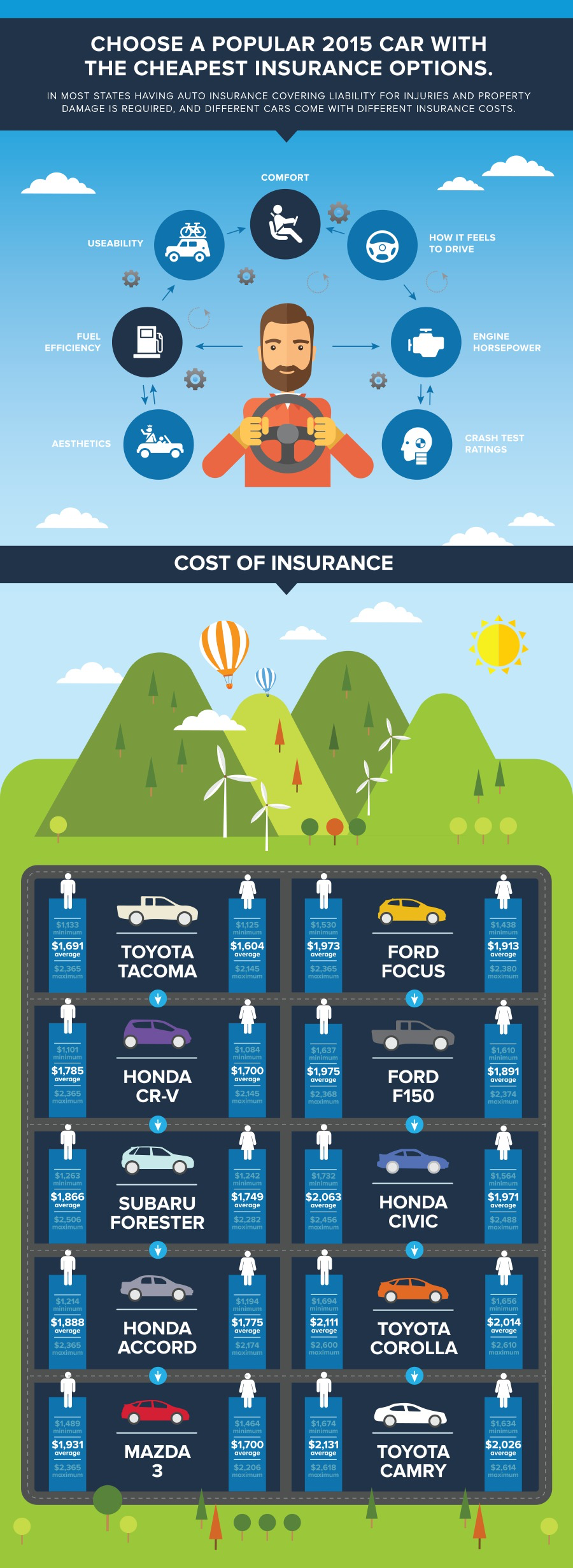

I bet you are wondering why a real estate agent would post about auto insurance, but the fact is, most people bundle home and auto. So here are some interesting tips about auto insurance for your reading pleasure.... Auto Insurance. Shopping for it is not enjoyable. Trying to figure out which policy is best for you is confusing. Typically we just like to choose the cheapest, however, depending on where you live geographically that may not be the choice as those of us located near or adjacent to our Southern Border must take into account the high percentage of uninsured drivers. Not only does this typically raise our annual premium, but usually it will require us to buy additional coverage. There are ultimately 7 primary factors that have the most significant impact on your insurance premium.

- Aesthetics

- Fuel Efficiency

- Usability

- Comfort

- Drivability

- Engine Horsepower

- Crash Test Ratings

Now it will not take a rocket scientist to figure out that driving a high performance sports car will yield significantly higher rates than say a small sedan. This infographic lists among the 10 most popular vehicles to drive as well as the upper and lower limits for what people pay for insurance. Thus, if you drive one of the vehicles described in the above infographic and are paying significantly more, perhaps you have a strong case to change carriers, or perhaps you are buying too much coverage. Regardless it’s always a good idea to do a bit of research to see what else is out there. Luckily with the digital age there are numerous ways to save time by comparing numerous carriers’ quotes at one time. One such company compare.com does this for Auto Insurance. So even if your car is not one of the 10 vehicles, it’s still worth a shot to give compare.com a visit and Compare Auto Insurance now to see if you could be saving money on your policy!

Written by Matt Lawler www.MattJLawler.com