BLOG

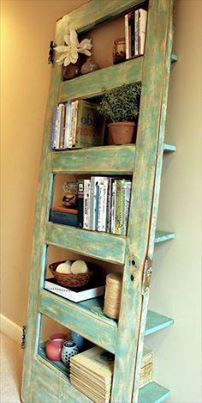

Repurpose An Old Door

You would be surprised what you can do with old items that normally put in the trash! Great imagination!

An old door as a bookshelf - brilliant!

Find your next home with me! Text LKHOMES to 87778 to download the MLS on your mobile phone, or visit http://87778.mobi/lkhomes to download the FREE app on your iPad/Tablet

Distressed Housing Market Shrinks Dramatically in Last 5 Years

Distressed housing market shrinks dramatically since housing downturn of Great Recession

Distressed housing market shrinks dramatically since housing downturn of Great Recession

LOS ANGELES (March 10) – Vastly improved home prices over the past five years have changed the landscape of California’s distressed housing market, which is now just a fraction of what it was during the Great Recession, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

In January 2009, 69.5 percent of all homes sold in California were distressed, which includes short sales and real estate-owned (REOs) properties. Five years later, that figure has shrunk to 15.6 percent. More specifically, REOs comprised 60 percent of all sales in January 2009, while short sales made up 9.1 percent of all sales but rose to as high as 25.6 percent in January 2012. Short sales currently make up 9.2 percent of all sales.

During the same time period, California’s median home price has soared more than 64 percent from $249,960 in January 2009 to $410,990 in January 2014.

“The dramatic drop in the share of distressed sales throughout the state reflects a market that is fully transitioning from the housing downturn,” said C.A.R. President Kevin Brown. “Significant home price appreciation over the past five years has lifted the market value of many underwater homes, and as a result, many homeowners have gained significant equity in their homes, resulting in fewer short sales and foreclosures.”

The statewide share of equity sales hit a high of 86.4 percent in November 2013 and has been above 80 percent for the past seven months.

In some of the hardest hit California counties, the distressed market in January 2009 was 93.6 percent in Stanislaus County, 93 percent in San Joaquin County, 89.5 percent in San Benito County, 86.1 percent in Kern County, 85.6 percent in Sacramento County, 84.2 percent in Fresno County, and 83.6 percent in Monterey County. The distressed market now has shrunk to 24.8 percent in Stanislaus, 25.1 percent in San Joaquin, 17.5 percent in San Benito, 18.4 percent in Kern, 19.9 percent in Sacramento, 26.3 percent in Fresno, and 16.9 percent in Monterey counties.

Of the reporting counties, San Luis Obispo, Orange, Santa Clara, and San Mateo counties held the lowest share of distressed sales in January 2014 at 10.2 percent, 9.5 percent, 7.7 percent, and 6.8 percent, respectively.

Leading the way...® in California real estate for more than 100 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with 165,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

Single-family Distressed Home Sales by Select Counties

| Distressed Sales by County | Jan. 2014 | Jan. 2009 |

| CA | 15.6% | 69.5% |

| El Dorado | 20.1% | 63.0% |

| Fresno | 26.3% | 84.2% |

| Kern | 18.4% | 86.1% |

| Los Angeles | 15.8% | 62.4% |

| Monterey | 16.9% | 83.6% |

| Orange | 9.5% | 60.3% |

| Placer | 15.1% | 68.1% |

| Riverside | 15.6% | 79.4% |

| Sacramento | 19.9% | 85.6% |

| San Benito | 17.5% | 89.5% |

| San Bernardino | 21.7% | 81.9% |

| San Joaquin | 25.1% | 93.0% |

| San Luis Obispo | 10.2% | 52.2% |

| San Mateo | 6.8% | 48.2% |

| Santa Clara | 7.7% | 68.0% |

| Santa Cruz | 11.6% | 56.6% |

| Stanislaus | 24.8% | 93.6% |

| Tulare | 20.0% | 45.8% |

| Yolo | 13.3% | 74.5% |

How to Claim Your Energy Tax Credits

How to Claim Your Energy Tax Credits

By: Donna Fuscaldo

Published: January 30, 2014

Energy tax credits on select improvements available through the end of tax year 2013.

Limits on IRS energy tax credits besides $500 max

- Credit only extends to 10% of the cost (not the 30% of yesteryear), so you have to spend $5,000 to get $500.

- $500 is a lifetime limit. If you pocketed $500 or more in past years combined, you’re not entitled to any more money for energy-efficient improvements in the above categories. But if you took $300 back then, for example, you can get up to $200 now.

- With some systems, your cap is even lower than $500.

- $500 is the max for all qualified improvements combined.

Certain systems capped below $500

No matter how much you spend on some approved items, you’ll never get the $500 credit -- though you could combine some of these:

System

Cap

New windows

$200 max (and no, not per window—overall)

Advanced main air-circulating fan

$50 max

Qualified natural gas, propane, or oil furnace or hot water boiler

$150 max

Approved electric and geothermal heat pumps; central air-conditioning systems; and natural gas, propane, or oil water heaters

$300 max

And not all products are created equal in the feds' eyes. Improvements have to meet IRS energy-efficiency standards to qualify for the tax credit. In the case of boilers and furnaces, they have to meet the 95 AFUE standard. EnergyStar.gov has the details.

Tax credits cover installation — sometimes

Rule of thumb: If installation is either particularly difficult or critical to safe functioning, the credit will cover labor. Otherwise, not. (Yes, you’d have to be pretty handy to install your own windows and roof, but the feds put these squarely in the “not covered” category.)

Installation covered for:

- Biomass stoves

- HVAC

Installation not covered for:

- Insulation

- Roofs

- Windows, doors, and skylights

How to claim the energy tax credit

- Determine if the system you installed is eligible for the credits. Go to Energy Star's websitefor detailed descriptions of what’s covered; then talk to your vendor.

- Save system receipts and manufacturer certifications. You’ll need them if the IRS asks for proof.

- File IRS Form 5695 with the rest of your tax forms.

This article provides general information about tax laws and consequences, but isn’t intended to be relied upon as tax or legal advice applicable to particular transactions or circumstances. Consult a tax professional for such advice, and remember that tax laws may vary by jurisdiction.

Find your next home with me! Text LKHOMES to 87778 or visit http://87778.mobi/LKHOMES for your FREE search.

Laura Key, CalBRELic #0198085

310.866.8422

C.A.R. Seller Survey: home sellers excited about the market

The home market is really hot in California. Homes across the price board are not staying on the market long. Price it right and they will come! See what homes are selling for in your area by downloading my MLS app at http://87778.mobi/LKHOMES It's free!

Home sellers excited about the market again; have confidence to repurchase, C.A.R. survey finds

LOS ANGELES (Jan. 16) – Home sellers are more optimistic about repurchasing a home than in the past few years, thanks to strong growth in home prices, record-low interest rates, and better personal financial situations, according to the CALIFORNIA ASSOCIATION OF REALTORS®’ (C.A.R.) “2013 California Home Sellers Survey.”

More than two-thirds (69 percent) of home sellers purchased a home after selling their previous residence, up from nearly half (47 percent) in 2012, and from only 12 percent in 2011.

“Much-improved housing market conditions in the last year have given sellers more confidence to own a home rather than to rent one,” said C.A.R. President Kevin Brown. “With sellers being more positive about the future of home prices, the vast majority of sellers who are currently renting plan to buy again in the future. In fact, 70 percent of sellers who are currently renting said they would purchase another home, up from 22 percent in 2012.”

Nearly half of sellers (43 percent) believe that home prices will rise in one year, compared to just 9 percent in 2012, and nearly three of five sellers (58 percent) believe home prices will increase in five years, up from 12 percent in 2012.

Additional findings from C.A.R.’s 2013 California Home Sellers Survey include:

• The reasons for selling changed significantly in just one year. In 2012, the majority of sellers sold primarily because of financial difficulties, but as home prices surged, a desire to trade up became the top reason for selling in 2013. Others wanted to take advantage of low interest rates to finance their next home, and some sellers believed the price of their home had peaked and wanted to cash out.

• Heightened market competition in the first half of 2013 led to an increase of multiple offers, nearly all home sellers (98 percent) said they received multiple offers, up from 83 percent in 2012. On average, each home sale received 5.9 offers in 2013 compared to 3.1 offers in 2012.

• Fierce market conditions also led to bidding wars, with nearly half (45 percent) of all sellers receiving offers higher than the asking price. In fact, more than one-third (37 percent) received three or more offers above asking price. Sellers, on average, received 2.2 offers above asking price.

• The Internet continued to be the most common resource for sellers to find an agent, with 51 percent of sellers finding their agent online. One-fourth of sellers used the agent with whom they had previously worked, up significantly from just 3 percent in 2012.

• Website listings were an integral part of the selling process, with more than two-thirds of sellers finding Realtor.com as the most important website in the selling process.

• Social media is playing a larger role in the home-selling process. Nearly three-fourths (74 percent) of sellers incorporated social media into the selling process, up from only one-fourth (24 percent) in 2010. Sellers used social media sites such as Facebook (83 percent); Twitter (52 percent); YouTube (39 percent); LinkedIn (24 percent); and Yelp (19 percent) to learn more about their agents or to communicate with them.

Source: California Association of Realtors http://www.car.org/

Home Underwater and You Feel Trapped?

What if I told you there is a legitimate program that will allow you to short-sale your current home and buy a home the next day? Yeap, I bet that got your interest. Some peoples homes are underwater due to no fault of their own. Yes, my friend....we can help! No crazy fills or frills...a honest to goodness solution for those who need help.

Contact me today for more details.

Laura Key, REALTOR® Laura.A.Key@gmail.com

Strange Real Estate in Los Angeles

Not exactly sure what this home owner is trying say with these decorations but if you own your own home, you can pretty much do what you want. Scary or art? What do you say?

Not exactly sure what this home owner is trying say with these decorations but if you own your own home, you can pretty much do what you want. Scary or art? What do you say?

Ready to purchase your own Masterpiece? Contact me to start your journey today! Laura.A.Key@gmail.com or text LKHOMES to 87778 to find homes now!

Home Design Inspiration For Your Bathroom

A few candles, a dimming light, a glass of bubbly, some music and some bubbles....YEAP!

Start your home search out RIGHT! Access homes from a direct source! Text LKHOMES to 87778 today or go to http://87778.mobi/LKHOMES Available on iPad/Tablet/Smartphones

Source: http://homedesignboard.com/bathroom/home-design-inspiration-for-your-bathroom-12/

As Home Prices Rebound, Lenders Rush to Unload REOs

The recovery in home prices this year is prompting banks to sell off their REO inventory at a brisker pace. Sales of bank-owned homes made up 10 percent of residential sales in November, the third consecutive month for increases in REO sales, RealtyTrac reports.

"Lenders are taking advantage of this environment to unload more of their bank-owned inventory and in-foreclosure inventory at the foreclosure auction," says RealtyTrac's Daren Blomquist. "But as the backlog of distressed inventory available dries up in many of the markets with the most efficient foreclosure processes — namely California, Arizona, and Nevada, with Georgia not far behind — overall sales volume is declining and will continue to do so until more nondistressed sellers enter the market."

Rick Sharga, executive vice president at Auction.com, says his company is “seeing more properties sold at trustee sales, and we are seeing more properties that are coming from servicers priced to sell at trustee sales.”

Previously, mortgage servicers would put foreclosed homes up for sale at the full value of the loan, CNBC reports. However, those homes would often land back at the bank as investors sought larger discounts. “Ironically, as prices are rising, servicers are discounting the homes more,” CNBC reports.

Start your home search out RIGHT! Access homes from a direct source! Text LKHOMES to 87778 today or go to http://87778.mobi/LKHOMES Available on iPad/Tablet/Smartphones

Source: “Sales of bank-owned homes surge,” CNBC (Dec. 20, 2013)

Laura Key - the Ultimate Answer to All Real Estate Needs (Press Release)

Laura Key - the Ultimate Answer to All Real Estate Needs

In the world of cut throat competition and greed where every penny is considered precious, Laura Key uses her heart while doing business. The real estate specialist has decided to donate $100 in her client’s name after the closing of every deal.

Los Angeles, CA -- (SBWIRE) -- 12/13/2013 -- Everybody has heard of real estate agents who brag about finding homes for celebrities, later using that as a tool to promote themselves and increase business. But, Laura Key is a REALTOR® with a difference, she is not only one of the most competent realtors that one can find around the Los Angeles and Beverly Hills area, but one of the very few realtors who has an inclination towards social service.

She has decided to donate $100 to one of the five non profitable organizations in the area, every time she closes an escrow- that too in the client’s name! Inspired by the popular quote- “Charity begins at home, but should not end there.” By Thomas Fuller, she makes sure that she is fulfilling her social responsibilities and returning a percentage of what she takes from it.

Making a business deal with Laura Key is one of the most convenient things to do. Unlike her competition, she is a professional who will provide her personal touch to understand every requirement that her client has. Her mobile application enables the users to find homes without having to compromise much on their busy lifestyles. They can find new homes or homes for sale from wherever at any given point in time. Her objective is to make sure that her clients have found their dream home where they can make memories at an affordable price. Her prices are genuine and the services that she provides are worth much more.

About Laura Key A prominent name in business for over seven years, Laura Key is a prominent name in the real estate business. She is a compassionate, enthusiastic and dedicated woman who will happily go the extra mile to make sure that her clients are satisfied with the outcomes of the deal that they strike with her. She understands that a home has a lot of sentimental value to the inhabitants and look at it as a place for solace, peace and comfort.

Media Contact: Name: Laura A. Key e-mail id: Laura.A.Key@gmail.com Ph. No.: (310) 866-8422 Website: http://www.KeyCaliforniaHomes.com

Find your next home with me! Instant and free access to the MLS! Text LKHOMES to 87778 or visit http://87778.mobi/LKHOMES! Available on Smartphones and Tablets!

Realtor Real Estate Agent Los Angeles Real Estate Sell Your Home Sell Your Los Angeles Home Buy A Home Buy Los Angeles Homes Selling LA Millionaire Real Estate Agent HUD Realtor HUD Real Estate Agent Luxury Homes Luxury Real Estate Homes Celebrity Realtor Celebrity Real Estate Agent California's Best Realtor California's Best Real Estate Agent Realtor Gives Back Realtor Charity Realtor Donation Santa Monica Real Estate Beverly Hills Real Estate Hancock Park Real Estate Windsor Square Real Estate Larchmont Real Estate Realtor with Heart Real Estate Agent with Heart Power Agent Power Realtor Power Real Estate Agent California Realtor California Real Estate Agent Venice Realtor Venice Real Estate Agent Culver City Real Estate Culver City Realtor Find Homes Free Free Homes List Free MLS Free CMA Free Comparative Market Analysis LA's Best Buyers Agent Los Angeles Buyers Agent Homebuyer Education Real Estate California Real Estate Home Sales Find A Home Los Angeles Zillow Agent Los Angeles Truila Agent Best Realtor Find a Realtor Find a Los Angeles Realtor Find a Santa Monica Realtor Find a Hancock Park Realtor Find a Windsor Square Realtor Find Luxury Home Realtor For Sale By Owner selling a home sell your home – how to sell your home sell house fast sell home fast selling house fast ways to sell your house sell my home fast home selling tips marketing your home sell your home fast selling your home fast staging your home to sell cost of selling your home house selling tips first time home buyer first time home buyers first time home buyer programs first time home buyers programs first home buyer tips first time home buyer tips Good Neighbor Next Door GNND Homes for Teachers Homes for Firefighters Homes for Police Homes for EMTwhen to buy a home how to buy a home home buying tips tips for home buyers mls listings multiple listing service multiple listing services mls multiple listing service mls real estate listings real estate listing mls condos for sale condo for sale villas for sale villa for sale townhomes for sale townhouse for sale town homes for sale town houses for sale house for sale buy home buying a home real estate listings real estate listing find real estate cheap houses for sale buy your home house 4 sale real estate agent listings big houses for sale find real estate for sale tips to sell your home short selling a home what is short selling a house tips for (on) selling your home tips to sell home tips to sell your home for sale by owner fsbo property for sale by owner properties for sale by owner sell your own home sell your own house selling your own home selling a home on your own for sale by owner listing for sale by owner listings listing property for sale by owner selling your house by owner selling your home without an agent foreclosure foreclosures home foreclosures short selling short selling short sale process short sales process foreclosure or short sale short sale vs foreclosure short selling your home realtors real estate agents real estate agent top real estate agents top real estate agent best real estate agents best los Angeles real estate agents best real estate agent best realtor find a realtor – how to find a realtor find real estate agents – how to find a real estate agent how to find a real estate broker finding a realtor

Tree Hugging REALTOR®

This weekend I had a wonderful time previewing homes in Hancock Park. You would think that since I see so many homes with clients the last thing I would want to do on a rare off Sunday is go see more homes! Sometimes you find treasures worth more than gold. Such is the finding of this fabulous tree. This great maze of branches and leaves still lives behind a multi-million fixer upper.

The minute you see this fallen beauty you know it has stories to tell. Children climbing it's branches, picnics under it's once upright limbs. You just don't see things like this everyday. And even though this old tree has fallen, it will still have many stories to tell. I do hope that the new owners leave it right where it is, so it can create future stories for all to wonder at.

There is something so rare, so beautiful and so peaceful about standing beside it. I could not fit the whole tree in a single photo. Look at the first photo, you will see the base and some of it's exposed roots.

Memories, precious memories this tree holds! I feel all the more wiser just for seeing this classic beauty!

Ready to start making memories of your own? Find your new home today! Text LKHOMES to 87778 for your FREE. Or call me today and let's get started on your personal journey! 310.866.8422

Hancock Park, Memories, California Homes, Holiday Joy, Childhood Dreams, Trees, Old Trees, Wisdom, Peace, Peaceful, Joy, Majestic, Realty Goddess, Realtor Goddess, Real Estate Agent, #1 Agent, Windsor Square, Mid-Wilshire

Green Cleaning Your Home

More and more homeowners are looking for ways to clean their homes with no chemicals. Here are a few "Green Cleaning" recipes that will help keep your home free of dangerous fumes. Enjoy!

Toilet Bowl Cleaner

1/4 cup baking soda 1/4 cup borax 1/2 cup vinegar

Dump in the toilet and let sit for 30 minutes, scrub and flush

Pan and Oven Cleaner

1/2 cup baking soda 1/3 cup hydrogen peroxide Vinegar in a spray bottle

Mix baking soda and hydrogen peroxide into a past and spread on oven or pan, spray thoroughly with vinegar and let sit for an hour, scrub clean

All Purpose Cleaner

Spray bottle 2 tbsp baking soda 1 tbsp Dawn dish liquid 4 tbsp white vinegar Warm Water

Shake and use as needed

Buyers: Ready to find your dream home?

Sellers: Keep on top of what homes are selling for in your area!

HOW: Text LKHOMES to 87778 for your FREE MLS app! Get your info directly from the source!

Beautiful Tile Work

This beautiful tile work was found in a bathroom located by the pool! Just Gorgeous! Its bright and detailed. In my opinion you just can't go wrong with mermaids by a pool.

Buyers: Ready to find your new home? Sellers: Want to see what homes are being listed at in your neighborhood?

It's easy! Text LKHOMES to 87778 for free MLS application.

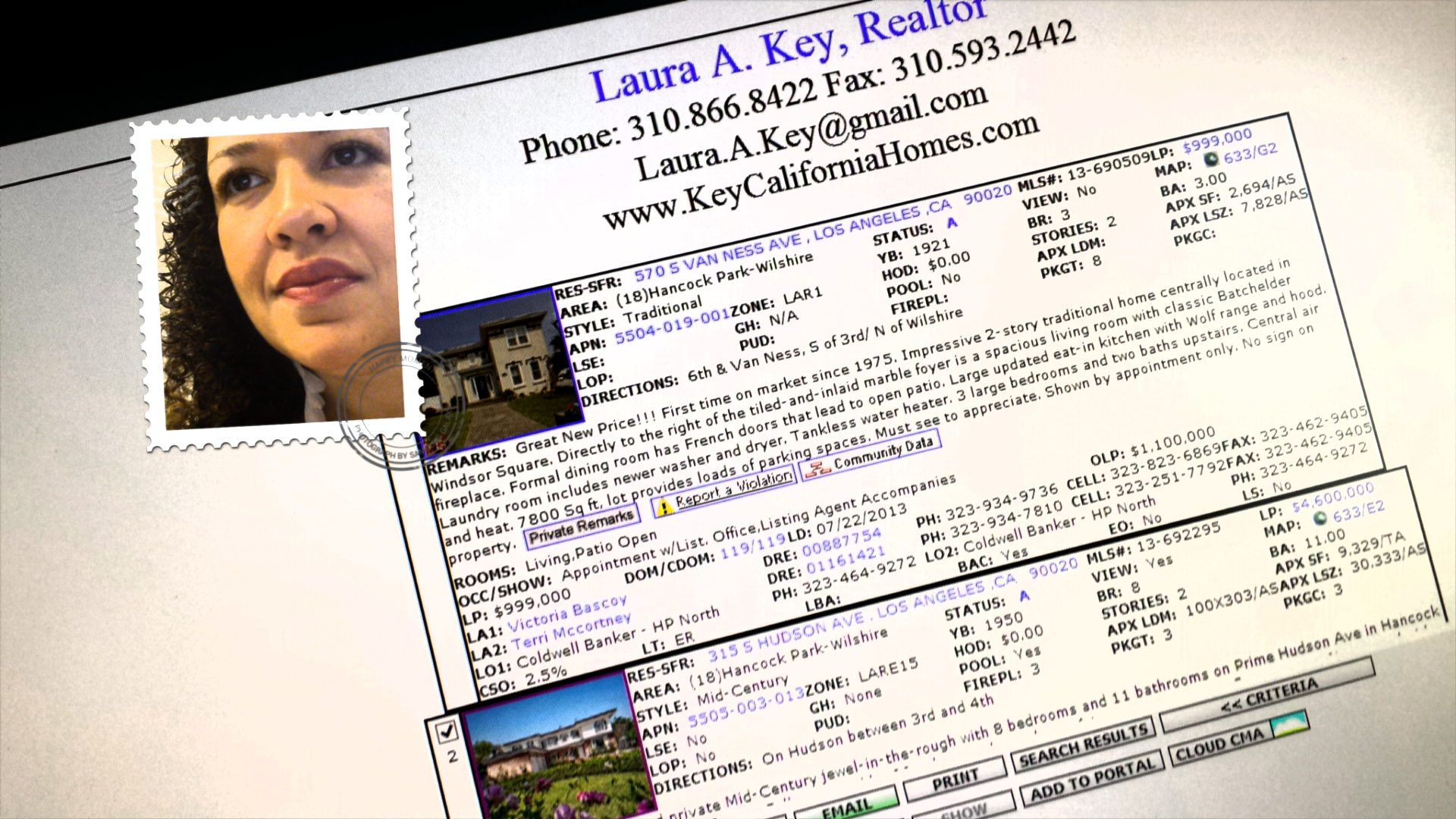

Hard at Work In Real Estate

Looking for A New Home? Text LKHOMES to 87778 to get instant free access to the MLS! Or Call me at 310.866.8422

Homes are turning over quickly in Los Angeles! Let me work hard for you!

California Real Estate, Los Angeles Homes, Homes for Sale, Larchmont Homes for Sale, Hancock Park Homes for Sale, Windsor Square Homes for Sale, West Hollywood Homes for Sale, Koreatown Homes for Sale, Realty Goddess, Top Los Angeles Real Estate Agent, Real Estate Agent, Realtor, MLS, Home Search

My New Favorite House in Hancock Park

Call Me for More Details 310.866.8422

Call Me for More Details 310.866.8422

I see a lot of homes daily, so when I came across this beautifully restored home located in Hancock Park my heart leap. For the past two years I have driven by this beauty on my way home, but one day I saw a fellow agent placing a "For Sale" sign outside beside the lovely rose garden! I rushed home to look up the details and saw it was going to be an open house. That Sunday my first agenda was to see this house and what I found made me fall in love more.

- 8 bedrooms 8 Bathrooms

- 12 foot ceilings

- 3 Floors

- Private nooks

- Garage with additional living/working space

- Rose Garden

- Porch

- Mature tree in the front yard

- Apx SF 6000 on a 9470 Lot

This home has history, it was been LOVINGLY restored to it's original glory and no detail was spared. This home is one that you simply must see and in my opinion is priced perfectly.

The time is perfect to purchase your new home! Text LKHOMES to 87778 to find your next home FREE! My app gives you DIRECT access to the SoCal MLS. No more fluff, no more outdated listings....just homes at your fingertips! Call me today! 310.866.8422

Beware of Rental Scams

Warning Regarding Online Rental Schemes

By Wayne S. Bell, Real Estate Commissioner California Bureau of Real Estate

Issued: October 2013

In prior consumer alerts, the California Department of Real Estate, the predecessor of the California Bureau of Real Estate (“CalBRE”) issued warnings to prospective renters about (i) imposter landlords and (ii) scams perpetrated by or in connection with Prepaid Rental Listing Services.

There are almost endless varieties of real estate and rental fraud. Some are new. Many are old, and some are just variations on timeworn scams.

CalBRE has received reports and been made aware of online rental scams (often using such Internet sites such as Zillow, Trulia, Craigslist, and HotPads), and we want to warn the public about some of the most common ones.

Included in this warning is a list of “red” flags or signs to look for, suggestions on how prospective renters can protect themselves, and reporting recommendations for those potential renters who have been victimized.

Common Scams

In most cases, the fraud involves a scammer who:

- Duplicates or “hijacks” an actual listing of a property that is for rent.

- Creates a fake or fictitious listing for a rental property.

- Offers for rent a real, but unavailable, property.

- Rents a property that is in foreclosure and which will soon be sold, or that has been fully foreclosed (or is in pre-foreclosure).

In the cases mentioned above, the perpetrators do not own the properties (although they oft-times pretend to be the owners) and they are not authorized or licensed to rent the properties.

In most of these cases, the scammers collect money (usually via wire transfer) from the victims for deposits, fees and rents, and in a number of the cases obtain enough personal information, such as social security, driver license and bank account numbers, to steal the identities of the “renter” victims.

For the fraudsters, these are crimes of opportunity and they are simply taking advantage of individuals who are looking for rental housing in a tight real estate market. The perpetrators engage in these crimes (via the Internet ether) because they have found success with such scams and continue to find victims who send money and/or who provide personally identifying information that can be used by the scammers to commit additional crimes.

Please see Consumer Alert – Beware of Imposter Landlords and Consumer Fraud Alert and Warning – Prepaid Listing Services (PRLS).

Because of the anonymity and widespread availability of the Internet, an online rental scam can be started and operated from anywhere in the United States or in other countries.

“Red” Flags

While none of the “red” flags below is definitive proof of fraud, the following are warning signs of a possible scam:

- The advertised rental rates are low (many times very low) compared to other rentals in the area. Always remember the time-tested adage that if something seems too good to be true, it probably is.

- The purported landlord or agent requests that the advance payment of rents and deposits (and possibly other fees) be made via cash or wire transfer (such as Western Union), and/or asks for personal information such as social security number, bank account information, and driver license number. It is important to note that payments made by cash or wire transfer provide little – and usually no – recourse, especially since the scammer to whom the funds are wired usually disappears and cannot be found. While credit card payments are not accepted by many landlords or property rental agents, prospective renters should – to provide an amount of self-protection – ask to pay for rents, deposits and fees by credit card.

- The supposed owner or rental agent is either out of the country or in another State, or is in a hurry to leave California, and states that the rental property cannot be shown or toured.

- The prospective landlord or property agent is not willing to meet in person, and/or applies pressure to complete the rental transaction as soon as possible.

Ways that Prospective Renters Can Protect Themselves

The best advice for prospective renters is to be wary, and to conduct their own diligence and investigate the person with whom they are dealing or negotiating, and the property itself. In this regard, potential renters should:

- Confirm or verify the identity of the supposed landlord or property agent. To see who owns the property, contact a licensed California real estate agent, the county recorder’s office in the county where the property is located, and/or a title company. Talk with neighbors about the property and ask who owns it, and ask a lot of questions about the rental history of the property. If dealing with a property manager or leasing agent (who does not live at the property), look them up on the CalBRE website (www.bre.ca.gov) to see if they are licensed. If they are, check to see if they are disciplined or otherwise restricted in the real estate practice that they can do. Also, check the person out on Google or other search engines, and through the Better Business Bureau.

- Confirm that the property is not in foreclosure or pre-foreclosure. This is especially true when renting a house. The mortgage loan should be in good standing and not in default.

- Not rent a property without viewing and touring it in person.

- Not pay or transfer any money without reviewing all rental documents, and getting copies of all writings pertaining to the property.

- Demand to meet and then actually meet the supposed owner or property manager in person, and ask many questions about the property and the neighborhood.

- Work with an experienced, competent, and licensed California real estate broker, or salesperson working under the supervision of a broker.

- Take photographs of the property.

- Not pay anything in cash or wire transfer money.

- Do research on what comparable properties rent for.

The essential point here is that prospective renters, in order to protect their interests, and not become a scammer’s next victim, must remain skeptical, proceed cautiously, do their own investigation of the property and individuals involved with the rental(s), and be aware of and look for revealing signs of fraud.

After Falling Victim or Becoming Aware of an Online Rental Scam

If a prospective renter has been scammed, or becomes aware of an online rental scam, he or she should immediately report the fraud and file complaints with one, more or all of the following:

- The relevant Internet provider (e.g., Zillow, Trulia, etc.).

- CalBRE if a real estate licensee is involved, or if the scammer is unlicensed and purporting to be a real estate agent. Please contact CalBRE at www.bre.ca.gov.

- The California Attorney General, at www.oag.ca.gov/consumers.

- The District Attorney, Sheriff, local police and local prosecutor in your community.

- The Federal Trade Commission, at www.ftc.gov.

- Federal Bureau of Investigation (FBI), at www.fbi.gov.

- The Consumer Financial Protection Bureau at www.cfpb.gov.

Issued: October 2013

Call Laura Key for your real estate needs, rentals, sales, purchase, investment! 310.866.8422 Search for homes NOW!

FHA Limits for Los Angeles Area

Homeownership is not out of reach. FHA limits in California are one of the highest in the country. I have great lenders that can help you reach your real estate goals! Call me to get started on your homeownership goals!!! Laura Key 310.866.8422

Here are the current limits for Los Angeles (as of August 23, 2013) FHA allows 3.5% downpayment over a 15 to 30 year term!

Single Family $729,750

Duplex $934,200

Tri-Plex $1,129,250

Four-Plex $1,403,400

Source: FHA.com

Feds Sue BofA over 2008 Bonds Backed by Prime Jumbo Mortgages

The federal government is accusing Bank of America Corp.of securities fraud, saying the second-largest U.S. lender lied to investors about flaws in supposedly prime loans, including some resembling subprime "liar loans," when it sold $850 million in mortgage bonds in 2008.

Lawsuits filed by the U.S. Justice Department and Securities and Exchange Commission are the latest in a long string of government and private mortgage-related civil actions targeting banks. BofA has drawn a disproportionate number because of the liability it shouldered in 2008 when it acquired the enormous subprime lender Countrywide Financial Corp. of Calabasas.

The new DOJ and SEC suits, filed Tuesday, are the first such government suits not to involve Countrywide, instead accusing BofA itself of wrongdoing. In another unusual twist, they focus on jumbo mortgages -- the outsized home loans designed for wealthy borrowers.

The SEC said losses so far to investors in the mortgage-backed securities have totaled about $70 million and may eventually reach as high as $120 million. The investors included the Federal Home Loan Bank of San Francisco andWachovia Bank, the East Coast giant that nearly failed and now is part of Wells Fargo & Co.

A BofA statement blamed the housing market collapse for defaults in the pool of loans backing the bonds, and said they performed better than similar bundled loans from that era. The bank maintained that it would show the bonds were bought by "sophisticated investors who had ample access to the underlying data" -- but presumably didn't bother investigating.

The DOJ said BofA made most of the loans through mortgage brokers, not telling the investors that it had learned at the time that these loans were defaulting at a high rate. BofA no longer makes mortgages through third-party channels.

Despite the affluent clientele, about 15% of the mortgages resembled the subprime "liar loans" that led to so many defaults, the DOJ suit said. These "Paper Saver" loans were made to self-employed borrowers without bank verification of their income or assets, it said, accusing BofA of not disclosing the percentage of the loans made in this high-risk manner.

"As Defendants knew, mortgages given to self-employed borrowers were more risky than mortgages given to salaried borrowers and stated income/stated assets mortgages given to self-employed borrowers were even riskier," the lawsuit said.

The DOJ lawsuit alleged violations of a 1989 law that allows the government to seek hefty civil penalties. It says that in addition to other problems, BofA violated its own underwriting standards in issuing the loans and did not perform a due-diligence investigation at the loan level when it securitized them.

Source: LATimes By E. Scott Reckard August 6, 2013, 4:45 p.m.

More Renters Say They Want to Own, Survey Finds

Interested in purchasing a new home! I have a team that can help you reach your real estate goals! Call me today! Laura Key 310.866.8422

The majority of renters say home ownership is one of their highest priorities for their future, and more renters are saying they want to buy soon, according to the 2013 National Housing Pulse Survey, conducted by the National Association of REALTORS®. Renters are showing stronger desires for home ownership compared to recent years, according to the survey.

“Home ownership matters to Americans who consistently realize the many benefits it provides to communities, families, and the nation’s economy,” says NAR President Gary Thomas. “Due to high housing affordability and today’s interest rates it makes sense for people to consider home ownership over renting. In fact, in many parts of the country it’s cheaper to own a home than to rent one. Therefore, it’s no surprise that renters recognize that owning a home offers tremendous long-term benefits and is an investment in their future.”

Fifty one percent of renters say that eventually owning a home is one of their highest personal priorities, up from 42 percent in the 2011 survey.

The survey found that 80 percent of the 2,000 Americans surveyed say they believe buying a home is a good financial decision. Sixty-eight percent said now is a good time to buy a home, too.

Their main motivations to home ownership: Building equity, wanting a stable and safe environment, and the freedom to choose where to live, the survey found.

Meanwhile, the main obstacles to home ownership have remained the same over the years: saving for the down payment, closing costs, low wages, and student loan debt.

“Student loan debt is a concern for many consumers in today’s market, especially first-time buyers,” Thomas says. “Buyers with student loan debt may find it difficult to access mortgage credit, as well as save for a down payment. Pending mortgage finance regulations requiring higher down payments could also contribute to the already tight lending environment. REALTORS® are working with regulators to address this issue and are committed to making sure those who are willing and able to own a home have the opportunity to pursue that dream.”