BLOG

Auto Insurance Shopping

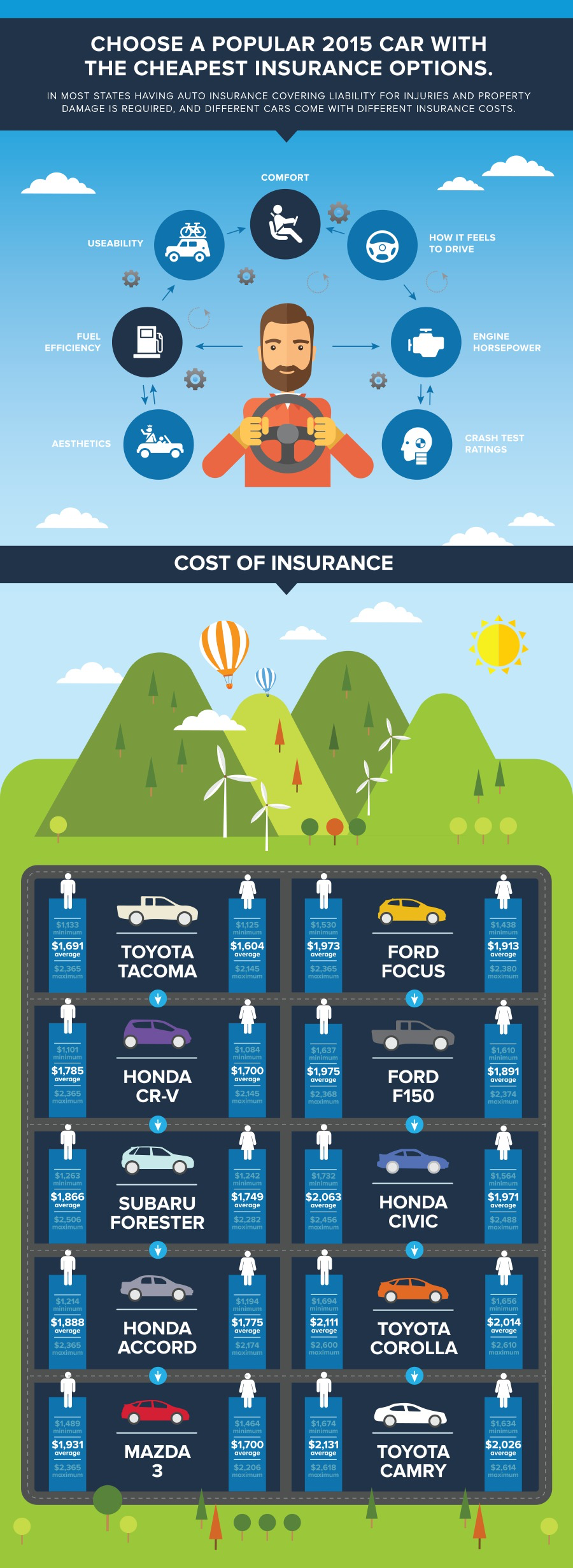

I bet you are wondering why a real estate agent would post about auto insurance, but the fact is, most people bundle home and auto. So here are some interesting tips about auto insurance for your reading pleasure.... Auto Insurance. Shopping for it is not enjoyable. Trying to figure out which policy is best for you is confusing. Typically we just like to choose the cheapest, however, depending on where you live geographically that may not be the choice as those of us located near or adjacent to our Southern Border must take into account the high percentage of uninsured drivers. Not only does this typically raise our annual premium, but usually it will require us to buy additional coverage. There are ultimately 7 primary factors that have the most significant impact on your insurance premium.

- Aesthetics

- Fuel Efficiency

- Usability

- Comfort

- Drivability

- Engine Horsepower

- Crash Test Ratings

Now it will not take a rocket scientist to figure out that driving a high performance sports car will yield significantly higher rates than say a small sedan. This infographic lists among the 10 most popular vehicles to drive as well as the upper and lower limits for what people pay for insurance. Thus, if you drive one of the vehicles described in the above infographic and are paying significantly more, perhaps you have a strong case to change carriers, or perhaps you are buying too much coverage. Regardless it’s always a good idea to do a bit of research to see what else is out there. Luckily with the digital age there are numerous ways to save time by comparing numerous carriers’ quotes at one time. One such company compare.com does this for Auto Insurance. So even if your car is not one of the 10 vehicles, it’s still worth a shot to give compare.com a visit and Compare Auto Insurance now to see if you could be saving money on your policy!

Written by Matt Lawler www.MattJLawler.com

More Renters Say They Want to Own, Survey Finds

Interested in purchasing a new home! I have a team that can help you reach your real estate goals! Call me today! Laura Key 310.866.8422

The majority of renters say home ownership is one of their highest priorities for their future, and more renters are saying they want to buy soon, according to the 2013 National Housing Pulse Survey, conducted by the National Association of REALTORS®. Renters are showing stronger desires for home ownership compared to recent years, according to the survey.

“Home ownership matters to Americans who consistently realize the many benefits it provides to communities, families, and the nation’s economy,” says NAR President Gary Thomas. “Due to high housing affordability and today’s interest rates it makes sense for people to consider home ownership over renting. In fact, in many parts of the country it’s cheaper to own a home than to rent one. Therefore, it’s no surprise that renters recognize that owning a home offers tremendous long-term benefits and is an investment in their future.”

Fifty one percent of renters say that eventually owning a home is one of their highest personal priorities, up from 42 percent in the 2011 survey.

The survey found that 80 percent of the 2,000 Americans surveyed say they believe buying a home is a good financial decision. Sixty-eight percent said now is a good time to buy a home, too.

Their main motivations to home ownership: Building equity, wanting a stable and safe environment, and the freedom to choose where to live, the survey found.

Meanwhile, the main obstacles to home ownership have remained the same over the years: saving for the down payment, closing costs, low wages, and student loan debt.

“Student loan debt is a concern for many consumers in today’s market, especially first-time buyers,” Thomas says. “Buyers with student loan debt may find it difficult to access mortgage credit, as well as save for a down payment. Pending mortgage finance regulations requiring higher down payments could also contribute to the already tight lending environment. REALTORS® are working with regulators to address this issue and are committed to making sure those who are willing and able to own a home have the opportunity to pursue that dream.”

Budget for Closing Costs – Home Inspection and Title Fees

Buying a home means you also have to budget for additional expenses! Make sure you put some money aside for the extras.

Purchasing a home is a euphoric event. Once escrow begins, the euphoria can change to frustration, particularly if you are not ready for the closing costs that quickly accumulate.

Closing costs simply refer to the fees associated with various things associated with the escrow process in a real estate transaction. In the excitement of having an offer accepted for your dream home, you can easily lose track of the fact you are going to need to have some serious cash on hand to pay them. Many people make the mistake of only assuming they need the down payment money, and have to rush around town trying to come up with money for the closing fees.

If you are buying a home, you need to get a professional home inspection. Doing so can reveal potential problems with the home that you wouldn’t otherwise notice. Problems can include things such as rot, termites, water leaks and a bevy of other issues. The time to do this is during escrow. Of course, that means you are also going to have to pay for the inspection. Depending on the size of the property, home inspections can run a few hundred dollars up to a few thousand. Make sure you have money set aside for the fees.

Title insurance is something you absolutely must purchase when you buy any real property, a home, building, land or whatever. Title insurance protects both you and your lender. Title insurance is just what it sounds like. A title company will research the title of the home and essentially guarantee that the title is good. This means the seller actually owns the title and has the right to sell it to you. The title company will also make sure there aren’t any liens on the homes or other things that will cause you problems. Depending on the price of the home, title insurance can run you a couple of hundred dollars or up into the thousands. Again, it is important to find out the cost and budget for it.

Title insurance and a home inspection are two things you should absolutely have when purchasing a home. Just make sure you budget for them.

Laura Key, BRE 01908085 310.866.8422 Laura.A.Key@gmail.com www.KeyCaliforniaHomes.comDo you work from home? Buy your next home with your office in mind!

If you work from home, and it is time to move to your next home, there are some factors you should consider carefully before making your decision.

The flexibility afforded by a “zero-commute” combined with the skyrocketing price of gasoline has strengthened the case for full time teleworking and telecommuting. According to an Environmental Protection Agency (2004) study:

“Americans spend an average of 46 hours per year stuck in traffic. Gridlock produces more than $63 billion in congestion costs per year”

The artist community has been well acquainted with the use of work/living spaces for years, but improvements in technology have made the benefits of teleworking and occasional telecommuting more attractive to general consumers. According to the key findings form the International Telework Association & Council (ITAC) Telework America (2000) study:

“Home-based teleworkers also have larger homes, on average, than non-teleworkers; the difference amounting to about 500 square feet. The most popular place for an office in these larger homes is a spare bedroom, with the living room a distant second. The primary home telework activity is computer work (55% of total activities), followed by telephoning, reading, and—averaging 7% of the time—face to face meetings.”

As you purchase your next home, there are certain factors to consider if you need to set up a new home office:

Make sure that your high-tech needs can be met. Have a qualified electrician inspect the wiring of the house to see if the system can handle the extra power load that your home office requires. Older homes may need significant upgrades to handle the extra power, while newer homes are built with more energy-efficient systems to handle the additional power along with heating/air conditioning requirements. If you use cable, DSL or satellite internet access, check with your local service provider to see if access is available in your new neighborhood. Shop around for your telephone provider—in some cases, business service bundles may be more cost effective than regular residential service.

Designate where your office space will be. Determine the amount of space you will need to accommodate your work style and space. In many cases a spare bedroom or living room space can be used, if a formal den option is not available. If your work requires heavy telephone usage or just heads-down concentration, you may want to consider utilizing a room with a door. Doors can be closed to reduce interruptions from other family and household noises.

Plan your office blueprint to include all required furniture, bookcases, computers, fax, and printers. Make sure to allow for filing and storage space for files and extra office supplies. Lighting is critical for computer or assembly work, so make sure to allow for direct sunlight along with any specific task lighting that may be necessary. Select flooring options that will allow you to work comfortably—you may wish to go with hardwood or laminate flooring to allow for your chair to move smoothly across the floor. Install enough phone lines to cover your home, business and fax machines needs.

Is the office easily accessible? If you will expect regular package deliveries, make sure that your designated office is easily accessible to the front door of the home. This is also necessary if you will need to meet clients or visitors in your office and would like to ensure a professional appearance for your business.

Find out about local business requirements. Some cities have zoning restrictions and guidelines for work/living spaces along with tax implications. Make sure to check with your local government to determine if special restrictions exist.

Are you ready to find a home that could allow you to work from home? Or...do you need more room in the current home you own? Give me a call - lets get you started!

Appraised Value: The Ups & Downs Of How Much A House Is Worth

How is the fair market value of a real estate property actually determined?

Determining Fair Market Value is an eternal struggle and major balancing act. That’s because buyers want a house to appraise on the low side—to keep the purchase price down. While sellers want the same house to appraise on the high side—to make the sale price higher. And then you’ve got the owners of the house—who also want the appraisal to be on the low side, in order to keep the property taxes down.

So with all these different agendas and points of view, how is the fair market value of a real estate property actually determined?

Once a year, your county sends all area homeowners official notices that put a dollar value on their property. And property taxes are based on those dollar values. But before those notices get sent out, a long, detailed process usually takes place. First, the land is valued as if it’s vacant—an empty lot, in other words. Then any improvements are described and measured. Improvements consist of the house and any other structures, pools, sheds, garages, and so forth. Next, most counties check the Marshall Valuation Service Cost Guide. It’s a standardized nationwide guide for determining the value of the cost per square foot to build a building that fits the description of the improved property. Next, if the house isn’t brand new, the replacement cost is considered, as well as depreciation; the year the house was constructed and the condition of the property are factors here. Appraisers then must take the critical step of comparing the value of the house with recent selling prices of similar homes in the neighborhood. At this point, the appraisal might stand “as is”—or it might be adjusted upward or downward.

Market Value is a theory, in other words—not an unchanging fact.

In a perfect world, you have to have willing buyer and a willing seller. Neither is under duress. Both are in a position to maximize gain and are trying to do this. But in the real world, things are rarely that simple and equally balanced. Which is why people feel differently about the appraisal value of a house. It really depends how strong their position is as a buyer or seller.

Does the local economy come into it at all? You bet it does.

Ask a successful Realtor about that! He or she will tell you they’ve noticed that the Rio Grande Valley’s fast-growing economy is attracting people from other areas who consider real estate here a bargain. That helps fuel increases in property values.

So—now you know where that Grand Total comes from.

You’re armed with the information you need to make a better house-buying decision. For instance, you can understand how two virtually identical houses that are in two different neighborhoods could be very far apart in price and appraised value. And why your choice of the right house in the right neighborhood could be worth a not-so-small fortune to you right now—and years down the road.

Sellers! You can get a great idea of how much your home is worth! Call me for a FREE Comparative Market Analysis (CMA) Laura Key 310.866.8422

5 Things You Should Know Before You Flip A Property

Money is made at the buy, not the sell of your flip. When flipping a house your money is made at the purchase not at the sell of the house. So, many times people buy a house with the intentions of making a huge profit only to find out that they could not make any money after all the renovations because the purchased price of the house was to high.

1. Money is made at the buy, not the sell of your flip. When flipping a house your money is made at the purchase not at the sell of the house. So, many times people buy a house with the intentions of making a huge profit only to find out that they could not make any money after all the renovations because the purchased price of the house was to high. When you purchase your property you need to be sure that you buy the house with enough money to make renovations, have carrying cost, and add about 5 $6,000. Now, cost is at $147,000, and that is if everything goes as planned. Profit is under 10,000 dollars. The mistake was made at the purchase at the home, not the sell.

2. Get an inspection on the home - Get a complete inspection done on your property. By, spending a few hundred dollars on this expense you can save thousands in problems that you cannot see. Foundation, Pest, Wood Rot, Etc... By, getting a full inspection you can rest assured that you know every thing that is wrong with the property before its to late. In the contact for the house you need to make sure that you have 7 days to have a inspection preformed, and if the inspection finds problems that are going to cost more money that you are willing to spend you can get out of the contract with no penalties.

3. Don't do the work yourself: - Get a contractor or several sub-contractors and have the work done quickly. You need to have you house flipped ASAP, so that you can get it on the market and get it sold. When I started flipping my brother and me did a house together, and we did all the construction. I had a construction background and figured it would save thousands, but it took us over 4 months to get the work done that a contractor could have had the work done in a month. But, we trying to save money on our flip did all the work on our time off and after work, and it just took to long. On our 2'nd flip we used contractors for almost everything and had the house completely flipped with a new roof, new air conditioning, new hardwood, and much more in only 3 weeks. We did not have to spend all our time working on the property and were able to spend that time looking for the next deal. This is how you get rich in real estate.

4. Place the property 1 to 2 percent below market value: If you are wanting to flip real estate and make money the object is to buy and sell the property as quickly as possible, so that you can move on to the next house. If you purchase a house and try to sell it at top dollar to make and extra couple of thousand dollars on your flip, and end up holding it for 6 months you are loosing money. Get the house on the market at a price that is going to blow the competition away, and you will sell it no matter what the market conditions. On our second house the market for selling house went down do to the housing market as a whole, and the tightening of the loans across America. We were told that you could not sell a property in this market, but we went ahead anyway and flipped our house. After 3 weeks on the market we had 3 people wanting to buy the house. Why, because we offered it at such a great deal that people wanted to jump on it. That is what you have to do especially if the market is slow.

5. Use a real estate agent - Do not try to sell you house on your own. Harness the power of a real estate agent and the power of the MLS system. When you do a FSBO you are depending on people driving by your house and seeing you sign, with a real estate agent you have someone actively marketing you house to get it sold. Once again this will free up more time for you to look for more great deals. If you want to help the process I have found that craigslist and listing you house in google adwords help to, but use these tools with the help of a agent such as Laura Key to make sure I have all my bases covered.

I hope this article has been helpful with the basics needs of flipping a house. If you will study and learn you will make money. But, do your homework before you purchase a house, and make sure that you can pull a profit on your deal. Then, make it happen! I am a Investor Friendly Agent, let's get you some deals! Laura Key 310.866.8422

Laura Key on CBS News

When It Comes to Wood Floors, Choose Wisely

Rich wood flooring can spell instant warmth and patina in a home. Here’s an overview that can help you evaluate if wood floors are right for you! Laura Key 310.866.8422

Just as with ties and hem lengths, wood flooring styles change. Colors get darker or lighter; planks get narrower or wider; woods with more or less grain show swings in popularity; softer or harder species gain or lose fans; and the wood itself may be older, newer, or even pre-engineered with a top layer or veneer-glued to a substrate to decrease expansion and contraction from moisture.

Here are key categories for consideration:

Solid Plank

This is what some refer to as “real” wood because the wood usually ranges from three-eighths to three-quarters of an inch in total thickness to permit refinishing and sanding. Thicker floors have a thicker wear layer to allow for more frequent refinishing and sanding, so they can withstand decades of use, says architect Julie Hacker of Stuart Cohen and Julie Hacker Architects. It also can be stained, come from different species of tree, and be sold in numerous widths and lengths:

- Width and length: Designer Steven Gurowitz, owner of Interiors by Steven G., is among those who prefers solid flooring for many installations because of its rich, warm look. Like other design professionals, he’s seeing greater interest in boards wider than the once-standard 2 ¾ to 3 ¾ inches — typically 5 to 6 inches now but even beyond 10 inches. And he’s also seeing corresponding interest in longer lengths, depending on the species. Width and length should be in proportion. “The wider a board gets, the longer the planks need to be, too, and in proportion,” says Chris Sy, vice president with Carlisle Wide Plank Floors. These oversized dimensions reflect the same trend toward bigger stone and ceramic slabs. The downside is greater cost.

- Palette: Gurowitz and others are also hearing more requests for darker hues among clients in the northeastern United States, while those in the South and West still gravitate toward lighter colors. But Sprigg Lynn, on the board of the National Wood Flooring Association and with Universal Floors, says the hottest trend is toward a gray or driftwood. Handscraped, antique boards that look aged and have texture, sometimes beveled edges, are also become more popular, even in modern interiors, though they may cost much more.

- Species and price: Depending on the preference of the stain color, Gurowitz favors mostly mahogany, hickory, walnut, oak, and pine boards. Oak may be the industry’s bread and butter because of the ease of staining it and a relatively low price point. A basic 2 ¼-inch red oak might, for instance, run $6.50 a square foot while a 2 ¼-inch red oak that’s rift and quartered might sell for a slightly higher $8.50 a square foot.

- Maintenance: How much care home owners want to invest in their floors should also factor in their decision. Pine is quite soft and will show more wear than a harder wood like mahogany or walnut, but it’s less expensive. In certain regions such as the South, pine comes in a harder version known as heart pine that’s popular, says Georgia-based designer Mary Lafevers of Inscape Design Studio. Home owners should understand the different choices because they affect how often they need to refinish the wood, which could be every four to five years, says Susan Brunstrum of Sweet Peas Design-Inspired Interior. Also, Sy says that solid planks can be installed over radiant heating, but they demand expert installation.

Engineered Wood

Also referred to as prefabricated wood, this genre has become popular because the top layer or veneer is glued to wood beneath to reduce expansion and contraction that happens with solid boards due to climatic effects, says Sy, whose firm sells both types. He recommends engineered, depending on the amount of humidity. If home owners go with a prefabricated floor, he advises a veneer of at least one-quarter inch. “If it’s too thin, you won’t have enough surface to sand,” he says. And he suggests a thick enough substrate for a stable underlayment that won’t move as moisture levels in a home shift.

His company’s offerings include an 11-ply marine-grade birch. The myth that engineered boards only come prestained is untrue. “They can be bought unfinished,” he says. Engineered boards are also a good choice for home owners planning to age in place, since there are fewer gaps between boards for a stable surface, says Aaron D. Murphy, an architect with ADM Architecture Inc. and a certified Aging in Place specialist with the National Association of Home Builders.

Reclaimed Wood

Typically defined as recycled wood — perhaps from an old barn or factory — reclaimed wood has gained fans because of its aged, imperfect patina and sustainability; you’re reusing something rather than cutting down more trees. Though less plentiful and more expensive because of the time required to locate and renew samples, it offers a solid surface underfoot since it’s from old-growth trees, says Lynn. Some companies have come to specialize in rescuing logs that have been underwater for decades, even a century. West Branch Heritage Timber,for instance, removes “forgotten” native pine and spruce from swamps, cuts them to desired widths and lengths, and lays them atop ½-inch birch to combine the best of engineered and reclaimed. “The advantage is that it can be resanded after wear since it’s thicker than most prefabricated floors, can be laid atop radiant mats, and doesn’t include toxins,” Managing Partner Tom Shafer says. A downside is a higher price of about $12 to $17 a square foot.

Porcelain “Wood”

A new competitor that closely resembles wood, Gurowitz says porcelain wood offers advantages: indestructibility, varied colors, “graining” that mimics old wood, wide and long lengths, quickness in installation, and no maintenance. “You can spill red wine on it and nothing happens; if there’s a leak in an apartment above, it won’t be destroyed,” he says. Average prices run an affordable $3.50 to $8 a square foot. The biggest downside? It doesn’t feel like wood since it’s colder to the touch, Lynn says.

Bottom Line

When home owners are making a choice or comparing floors, Sy suggests they ask these questions:

1. Do you want engineered or solid-based floors, depending on your home’s conditions?

2. Do you want a floor with more natural character, or less?

3. What board width do you want?

4. How critical is length to you in reducing the overall number of seams?

5. What color range do you want — light, medium, or dark?

6. Do you want more aggressive graining like oak or a mellower grain like walnut?

7. Do you want flooring prefinished or unfinished?

8. How thick is the wear layer in the floor you’re considering, which will affect your ability to refinish it over time?

9. What type of finish are you going to use? Can it be refinished and, if so, how?

10. For wider planks that provide greater stability: Where is the wood coming from, how is it dried, what is its moisture content, and what type of substrate is used in the engineered platform?

Thinking of selling your home? A little investment can increase your resale value! Call me for a personal consultation! Laura Key 310.866.8422

What to Expect At a Foreclosure Auction

Whether you are an investor that would like to get into buying foreclosed homes for your personal use! Call me today! Laura Key 310.866.8422

Whether you are an investor that would like to get into buying foreclosed homes for your personal use or to flip the property or if you are having your home foreclosed on, you should know what to expect at a foreclosure auction. Of course, the actual steps that will be taken can vary a bit from state to state and from house to house, but it’s good to know what you will be getting into when you go to a foreclosure auction. Foreclosure auctions can be exciting, even fun, but knowing what to expect will help you make the most of the experience, whether you are an investor or a homeowner that is trying to get your house back.

Before the Auction

You’ll likely find out about the foreclosure auction in a local newspaper and on the flier may be information to pre-qualify for bidding. This will allow you to put down a deposit so that the auctioneer knows that you are a serious bidder and can fulfill your bid if you are the winning bidder. Being pre-qualified just sort of speeds up the process so that you don’t have to mess around with the deposit on the day of the auction. During this time you should also do some research on the house by looking into any liens that may be against the property, how much the property is worth, how much it has appreciated in the last few years, as well as property values in the area. If the home looks as though it will need some repairs, you should consider this as well when trying to come up with how much you will be willing to pay for the house. Without this research, no amount of knowledge about what goes on at a foreclosure option will help you because you won’t know where to start when it comes to actually making a good bid.

What Happens At the Auction

The auction will typically start with the auctioneer reading legal notices as well as a legal description of the property. The auctioneer will usually then begin taking bids on the property. If the auctioneer has pre-qualified bidders the process is more streamlined, if not, each time a bid is made the auctioneer will then ask for the bidders deposit check, which is typically right around $5,000 for residential auctions. After each bid the auctioneer will attempt to solicit bids for higher amounts. Each auction is different, but the auction increments usually are set by the auctioneer and may be by $100, $500, or $1,000 per bid. The auctioneer will continue to solicit bids by this increment until it is clear that the highest bid has been reached. Then, the auctioneer will announce, “Going once, going twice, three times, sold!” indicating that the auction is over and the property has been sold to the highest bidder.

Once the bidding has ended a foreclosure deed and purchase papers will be drawn up and validated by the new owner or purchaser and the mortgage holder. A grace will likely be given to allow the purchaser to find financing or to come up with the funds to cover the full amount of the bid. This grace period is usually 30 days unless the purchaser and the mortgage holder agree to other terms. After the grace period a closing will take place, so that the new owner can formally take the title to the property.

What Happens, Now?

The purchaser can do what he or she intended to do with the property, whether it is to move into the home or to sell it for full market value. The money paid by the purchaser will be distributed in order of priority, first of which would be taxes. After taxes money will be paid to the mortgage, then the second and third mortgage if applicable. If there is still money after paying these debts, remaining money will be paid to lien holders and creditors. There is a very slim chance that there will be money left over after all of the debts are paid, if this is the case then the monies will be paid to the former home owner.

What about the Original Owner?

The original owner will often be at the auction so that they can bid on their home, and this is legal as long as they have the deposit required. If the owner of the home that has been foreclosed does bid on the home they must remember that the deposit is not refundable and the deposit assumes that they will be able to finance the home within the grace period. Owners must also remember that if they buy the property back old debts may merge and become reinstated such as second and third mortgages that became void when the first mortgage foreclosed on the property unless one has filed bankruptcy and is truly free and clear of these debts. Owners will often drum up the funds to make the deposit so that they can have another 30 days to try to save their home. Owners may or may not be successful in their attempts to save their home at a foreclosure auction.

As you can see, there are a lot of things that go into a foreclosure auction, but none of them are all that difficult to understand, but knowing about them makes the auction more enjoyable. The auction itself is not all that complicated, but it can be very fast paced. At some foreclosure auctions there are a lot of people, at others there are only a few because of the location or just the debts attached to the property, or even the state of the property. If you are serious about the property you should pay close attention when bidding starts so that you are sure that you can get your bid in when you feel it’s time so that you have the best chance of being the top bidder.

Call me for more info! Laura Key 310.866.8422

4 Steps To Real Estate Investing Success!

Real estate investing is always good and sometimes it's red hot. When it's hot dozens of real estate seminars begin rolling across the country and thousands of people spend thousands of dollars for investing education. One good resource is to have an Agent who is Investor friendly! Call me and let's chat! Laura Key 310.866.8422

Real estate investing is always good and sometimes it's red hot. When it's hot dozens of real estate seminars begin rolling across the country and thousands of people spend thousands of dollars for investing education.

It's startling to learn that of all those thousands of eager folks who attend these seminars only about 5% buy even one investment house. Why? The real estate gurus sell the "sizzle" and make profiting from real estate sound easy. The truth is that it's simple, but not easy.

Here's a quick plan that will enable anyone to begin building financial independence.

There are basically four steps to investing in single family homes:

1. Buy homes below full market value. Yes, people really do sell homes for less than the home's full value. The key is to understand that most home owners will only consider a purchase offer that is all cash and within 5% to 10% of their asking price.

The successful investor learns to find financially distressed home owners who have no choice but to sell for less than market value. They have lost their job or been suddenly transferred; they are divorcing; they been living beyond their income; the family has been overwhelmed with medical bills and, not uncommonly these days, their money has gone to support a drug habit.

Those are examples of motivated sellers. They have to sell and they will accept something other than a conventional, all cash offer.

2. How do you find motivated sellers? You work at it! Like any business it is important to develop a little marketing plan. One that is simple, yet very effective, is the one that was proven 75 years ago by the Fuller Brush company; door to door sales.

You are selling your skill as a home buyer to people who must sell. Your are there when they need you and you have the skill to help them solve at least part of their problem. With door to door prospecting you will learn more and buy more homes quicker than any other method. However, most people just won't walk door to door for three or four hours per week. OK, there are other ways.

You can watch public notices for the announcement of foreclosure sales. Meeting with a home owner right after they've received a notice that they are about to lose their home allows you to deal with a very motivated seller. Other public notices that provide buying opportunities include probate, divorce and bankruptcy. You can follow the Homes For Sale listings in your local newspaper or Internet site.

You can telephone the names found in these notices or, and this is the least time consuming, send a postcard expressing your interest in buying their property. It will produce buying opportunities, just not as many as personal contact.

3. After you've found a motivated seller you must understand how to frame offers that provide benefits for both you and for the home owner. A good real estate investor quickly learns that this is not a business of stealing property, but of solving problems in a way that benefits the seller.

The home owner is in a tight spot of some kind and you can save them from public embarrassment and, in most cases, give them at least a little cash to get a new start.

No investor can afford to leave cash in every deal. No one but Bill Gates has that much available money. You must use creative techniques like, leases, option and taking over mortgage payments. Little or no cash is needed for those deals. You can find plenty of reasonable priced educational material on those subjects in book stores or on EBay. The same education that seminars sell for thousands of dollars.

4. You make your profit when you buy! Never make a purchase until you've carefully determined exactly how you will get to your profit. If you hold it as a long term investment will the monthly rental income more than cover the monthly mortgage payment? Will you sell the deal to another investor for fast cash? Will you do some fix-up and sell the property for full value? Will you quickly trade it for a more desirable property? Have a plan before you buy.

There you have four steps that even a part-time investor can execute in three to four hours per week. What's the missing ingredient? Your determination and perseverance. If you will unfailingly follow the plan for a few months you will be well on your way to financial independence.

CALL ME TODAY TO HELP BUILD YOUR PORTFOLIO! Laura Key 310.866.8422

Definition of Prescriptive Easement

Call me if you have some questions about a Prescriptive Easement! I have a team that can help you if you have concerns! Laura Key 310.866.8422

A prescriptive easement creates a right to use another's land for a specific purpose. The easement is created by making use of the land without owner permission for a period of time specified by statute. Interference with a prescriptive easement gives the easement holder cause to bring suit.

Easement in General An easement creates a right to use land that is possessed by another for a specific purpose. One parcel of land, the "dominant tenement," enjoys the benefit of the easement, while the "servient tenement" is the land being used for the easement purpose. Once an easement is validly created, even if not used, it is presumed to be perpetual.

Prescriptive Easement A prescriptive easement is acquired when the servient tenement is used for a specific purpose, for some time without the permission of the owner. Through the continuous use and the owner's failure to stop it, the dominant tenement can acquire the right to use the servient tenement property indefinitely. A prescriptive easement is a type of easement appurtenant, meaning that the holder receives physical use or enjoyment of the property. All who may succeed to title of the dominant tenement will be entitled to the prescriptive easement; the easement need not be mentioned in the conveyance or deed in order to be operative.

Elements Speaking generally, for legal elements are usually required: adverse use (use of the servient property without permission of the owner); open and notorious use (with no attempt at concealment); continuous use for the entire statutory period (required statutory periods vary among states, but the minimum is five years); and hostility, meaning that hte easement user knowes he has no right to use the property. However, individual state' easement laws may display variations, and those with easement issues should consult a legal professional.

Exclusive Use Jurisdictions are split on weather a prescriptive easement requires that adverse use of the property be exclusive in order to fulfill the legal element. A minority of jurisdictions will not allow a prescriptive easement if other parties besides the dominant tenement have also been using the servient tenement adversely for the same use. However, most do not require exclusive use, only that the dominant tenement's right to adversely use the easement "does not depend on a like right in others". In other words, the dominant tenement may still get the prescriptive easement even if the owner or others are also using the tenement in a similar manner.

Termination of Easement As an owner may prevent establishment of a prescriptive easement by effectively ending the dominant tenements adverse use; this can be accomplished by bring suit or physically ejecting the easement user from the property. Easements can also be terminated in several ways; the easement holder can release the servient tenement from the easement; the dominant and servient tenement can merge ownership; or the servient tenement can be condemned. The servient tenement may also invalidate the easement by a sort of "reverse prescription," if the servient tenement uses the easement for a long time and the easement holder "sleeps on his rights."

Source: http://www.ehow.com/about_6501555_definition-prescriptive-easement.html

Does Moving Up Make Sense?

Don't get caught up in the madness of the market. Deciding to sell is a personal decision, take everything into account. I am here to assist! Laura Key 310.866.8422

These questions will help you decide whether you’re ready for a home that’s larger or in a more desirable location. If you answer yes to most of the questions, it’s a sign that you may be ready to move.

- Have you built substantial equity in your current home? Look at your annual mortgage statement or call your lender to find out. Usually, you don’t build up much equity in the first few years of your mortgage, as monthly payments are mostly interest, but if you’ve owned your home for five or more years, you may have significant, unrealized gains.

- Has your income or financial situation improved? If you’re making more money, you may be able to afford higher mortgage payments and cover the costs of moving.

- Have you outgrown your neighborhood? The neighborhood you pick for your first home might not be the same neighborhood you want to settle down in for good. For example, you may have realized that you’d like to be closer to your job or live in a better school district.

- Are there reasons why you can’t remodel or add on? Sometimes you can create a bigger home by adding a new room or building up. But if your property isn’t large enough, your municipality doesn’t allow it, or you’re simply not interested in remodeling, then moving to a bigger home may be your best option.

- Are you comfortable moving in the current housing market? If your market is hot, your home may sell quickly and for top dollar, but the home you buy also will be more expensive. If your market is slow, finding a buyer may take longer, but you’ll have more selection and better pricing as you seek your new home.

- Are interest rates attractive? A low rate not only helps you buy a larger home, but also makes it easier to find a buyer.

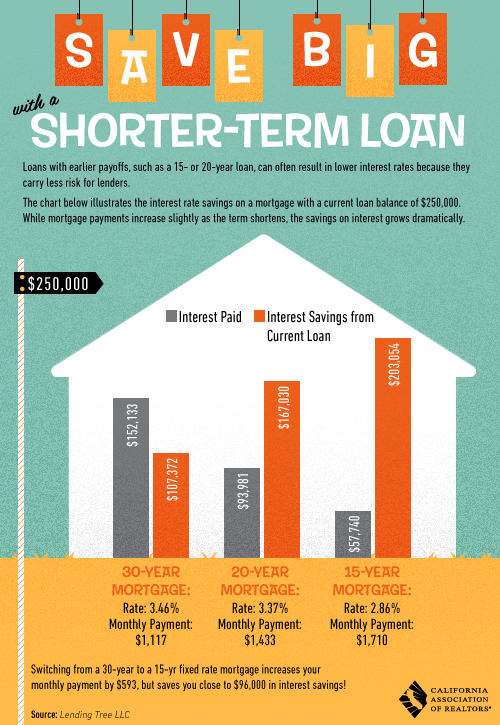

Study: Buyers Can Afford Bigger House If It's New

Good News on the Home Front! Ready to Buy! Let's do this together! Laura Key 310.866.8422

The National Association of Home Builders says its new study shows that home buyers can buy a more expensive, newer house and still have the same operating costs as owning an older existing home.

NAHB examined data from the Census Bureau and Department of Housing and Urban Development’s 2011 American Housing Survey to determine how utility, maintenance, property tax, and insurance costs vary depending on the age of a home.

Houses built prior to 1960 have average maintenance costs of $564 per year. On the other hand, homes built after 2008 have average maintenance costs less than half that — $241, according to the study.

For homes built prior to 1960, operating costs average nearly 5 percent of the home’s value while the average was less than 3 percent for homes built after 2008, the NAHB study found.

The study also took into account the first year after-tax cost of owning a home by its age, examining the purchase price, mortgage payments, annual operating costs, and income tax savings. “A buyer can afford to pay 23 percent more for a new house than for one built prior to 1960 and still maintain the same amount of first-year annual costs,” according to NAHB.

New houses tend to cost more than existing homes, so the mortgage payments will likely be higher — but the lower operating costs of a newer home will give buyers annual costs that could be about equal if they purchase a lower priced, older home with a smaller mortgage payment but higher operating costs, NAHB says.

"Home buyers need to look beyond the initial sales price when considering whether to buy new construction or an existing home," says NAHB Chairman Rick Judson. "They will find that with the higher costs of operating an older home, they can often afford to spend more to buy a new home and still have annual operating costs that fit their budget."

Source: National Association of Home Builders

Are First-Time Buyers Being Shut Out?

Speaking from the trenches, I can honestly say it's hard to find buyers home right now. There are multiple offers and investors who offer in cash! Yet, it's not impossible! Call me today for more info and insight on what you may be facing as a buyer! Laura Key 310.866.8422

Across the country, first-time home buyers have been putting in offers on homes, but many of them keep losing out.

One working mother says she’s put in 30 offers on homes in the $100,000 range in the Atlanta area, bidding $2,500 to $3,000 above the asking price, but each time she’s been outbid. “We have to be on top of the game and be able to drop everything and check out a house or it will be gone,” says another couple in Alexandria, Va.

Tight housing inventories are playing a role. For example, in Boston home listings are down 57 percent and in Atlanta area home listings have dropped nearly 40 percent in the past year.

Also, “investors have been pushing home prices higher faster than expected,” Diana Olick reports for NBC. “But the higher prices get, the more investors may get out, because they won’t be able to find such great bargains any more. That in turn will let regular buyers back in, even if they do have to pay a little more to own.”

Source: “First-time Buyers Struggle as Home Prices Rise,” NBC (March 26, 2013)

Search SoCal homes for free from my Facebook page! www.Facebook.com/RealtyGoddess

Buying a House at Foreclosure Auction is Risky Business

You can buy a home at a significant discount at a foreclosure auction, but you’ll face a host of challenges. Don’t get burned; be solutions-ready.

Start by understanding the foreclosure auction rules for your area. State and local governments set their own rules for such factors as:

- Bidding process

- Amount of deposit

- Where the auction is held

- Whether the home owners can get their properties back after the sale

You can learn about the process in your area by talking to officials at your county tax department or to a REALTOR®.

Although foreclosure auctions follow local rules, there are some universal challenges you’ll face no matter where you shop for foreclosed properties. Here’s how to solve them.

Solutions to 6 common foreclosure auction challenges

1. Challenge: Getting reliable information about foreclosure sales. Many companies charge fees to send you lists of foreclosures that may not be current, or sell expensive foreclosure-buying “systems” that promise to teach you how to make millions in real estate.

Solution: Most foreclosure sales are still announced in local newspapers. And you can get accurate information about buying foreclosures from reliable book publishers:

Foreclosure Investing For Dummies (For Dummies, 2007)

Keys To Buying Foreclosed and Bargain Homes (Barron's Educational Series, 2008)

2. Challenge: You can’t get inside the property before the auction to inspect it forstructural problems and repairs. Many foreclosure auction properties are in bad shape because the owners couldn’t afford the upkeep. And sometimes angry home owners purposely damage the property to punish the foreclosing lender.

Solution: Walk around the home to check its exterior condition. If it’s vacant, look through the windows. Ask the neighbors what they know about the property. If it was a rental, check the inspection records on file with the local government.

You can safely assume there’s something wrong with any house sold at a foreclosure auction, so cover yourself by bidding no more than 70% of the home's market value.

3. Challenge: You need to figure out the market value of the house to prepare your bid. Some foreclosure auction announcements include information about the size of the original mortgage. That’s not how much the house is worth or even what the owners owe now. If the current owners bought at the top of the market, their mortgage may be more than the home is worth in today’s market and they could owe even more if there’s a second mortgage on the house.

Solution: Commission your real estate agent to do a broker’s price opinion (BPO) on the home you want to bid on. The BPO will show you comparable sales, telling you what similar, nearby homes that weren’t foreclosure sales have recently sold for.

Bid well below those comparable sales to leave yourself room to pay for repairs and unexpected problems. Ask the agency that runs the auction how to find winning bid amounts from recent auctions. Use that information to guide your current bid, too. A look at local tax and assessment records will tell you more about previous and current auction properties, like square footage and lot size.

4. Challenge: You don’t know if there are liens on the home. Some auctions don’t give you clean title to the property, meaning liens from the federal government or other entities may not be removed during the foreclosure auction process. You’d have to pay off those liens if you won the property.

Solution: Focus your efforts on two or three homes in desirable locations. To find out about any liens, pay a real estate attorney to run a title search on each property and issue a commitment to insure the title after purchase. Ask how the policy treats liens filed between the time of the search and the time you close.

A less-expensive option: Hire an independent title search professional called an abstracteror an online company. Both search options should be under $200, title insurance costs vary by state.

5. Challenge: You have to pay cash and pay it quickly. Most auctions require bidders to come up with the full purchase price in cash within 30 days.

Solution: Don’t count on getting a mortgage that fast. Look for other sources of cash that make financial sense for you.

- Take out a home equity line of credit or do a cash-out refinance.

- Tap retirement accounts, provided it makes sense for you from a tax perspective.

- Work with other investors to fund a partnership to invest in foreclosed homes.

6. Challenge: You’re in love with a house that you’re aware is headed to foreclosure, but you’re afraid to bid on it at the foreclosure auction because you know nothing about the process.

Solution #1: Contact the owners and offer to purchase the home as a short sale. That’s where the bank agrees to let the owners sell for less than what they owe on the mortgage.

Solution #2: You may be able to buy the house after the foreclosure sale. Foreclosure sales are run by a government agency (often the sheriff), which collects the money from the highest bidder and gives it to the bank to pay off the mortgage.

Banks will often bid at the sale to make sure someone doesn’t pay less than the house is worth (translation: not giving the bank enough money to satisfy the mortgage).

If the bank is the high bidder, it’ll take title to the house and put it up for sale. Then, buying the home is just like buying any other house. You can buy an owner’s title insurance policy so you know the house is free of liens; you can get a home inspection to check for needed repairs; and you’ll have plenty of time to line up your financing.

A real estate agent can alert you the day the bank puts the home on the market, so you can submit your purchase offer.

Since the bank pays the real estate agent’s fees, you likely won’t pay more than you'd have bid at the foreclosure auction to outbid the bank, and you’ll avoid most of the risks and unknowns of buying at the auction.

Ready to purchase your home! Start by taking one of my Free Home Buyer Seminars! Your will learn everything you need to know from Lending to Escrow! Call to schedule today! Laura Key 310.866.8422

Source: houselogic.com - Marcia Jedd, who covers a range of home and real estate issues, dreams of stumbling upon a foreclosure sale where a vacation lake cabin in northern Minnesota is being sold free and clear at a deep discount. Her bylines include many local and national publications, including FrontDoor.com, HGTVPro.com, Kitchen & Bath Ideas, and Professional Builder.

The Life of Our Home

What a wonderful adventure! Building your own home may be the option for you! Contact me with any questions you may have! 310.866.8422

Why Do You Need An Agent When Buying A Home?

My immediate response to that question is "Why wouldn't you?" For one thing, many people don't know that a buyer doesn't pay an agent; the seller does, so the services of a real estate agent are essentially free to the buyer. Also, a buyer's agent has access to historical price data for home sales in the area, which means he can recommend a bidding strategy based on real market data. Even though a lot of this kind of information is now available online, agents are much better able to analyze and interpret the data.

Many buyers will contact the agent listed with the property or walk into an open house thinking the listing agent will be working in their favor. But the seller's agent is contractually obligated to act in the seller's favor and get as close to the asking price as possible. They are not working for you.

Then there is the process of actually making an offer and handling all the details of a purchase contract. Aside from the fact that an agent is probably better at negotiating an offer than you are, there's a lot more involved than just making an offer.

There are many questions that a buyer just wouldn't ordinarily think to ask - things that could affect the outcome of the transaction. What should be included or excluded? How much time should be allocated to inspections, financing and closing? Are there any other conditions that could affect the sale?

Buying a home is a legal transaction for a great deal of money involving a whole host of local and federal laws and regulations. You will be much better off having someone in your corner who deals with these things every day.

I'd be more than happy to discuss this further or answer any questions you may have about real estate. Just give me a call.

Buying a Home is not like buying a pair of shoes or a car! You will have to season your investment for at least 5-7 years in a good market to obtain your reward. You need an expert to help you obtain your Real Estate goals. Call Laura Key today to start your journey and reach your goals! 310.866.8422 or email her at Laura.A.Key@gmail.com

Loans for Fixer Uppers

Low housing inventory has resulted in a lack of move-in ready homes available for sale. Many buyers, especially first time buyers, tend to overlook properties in need of extensive repairs, but a federally backed lending program enables buyers to roll the cost of necessary repairs into their mortgage, which can sometimes yield a quick return on investment.

Making sense of the story

- The Federal Housing Administration’s 203(k) program provides for loans that cover purchase and renovation costs for single-family homes and multifamilies with up to four units. The total loan amount is based on the property’s appraised value once the repairs are completed. The down payment requirement is 3.5 percent.

- FHA 203(k) loans are not available to investors – borrowers must live in the properties. But some borrowers have used a 203(k) loan to buy and renovate a multifamily property, live in the property for a year or so, refinance into a conventional loan, and then sell the rehabbed property.

- The loans are more expensive than conventional financing, because the interest rates are slightly higher and private mortgage insurance is required.

- Additionally, borrowers must pay a building consultant, who writes the initial estimate of the cost of planned repairs. Fees range from $400 to $1,000, depending on the extent of the repairs. The consultant also ensures that the repairs will bring the house up to government health and safety standards.

- The loans do not cover the addition of luxury items, such as a pool. But allowances are made toward the cost of repairing or removing a pool, as well as for the addition of solar panels.

- Renovations must be made within six months after closing. The contractor is paid in intervals after periodic inspections of how the work is progressing. Borrowers should make sure they hire experienced contractors who understand that they won’t be paid upfront and must adhere to strict timelines.

For more information contact Laura Key, Real Estate Agent at Laura.A.Key@gmail.com

www.KeyCaliforniaHomes.com

Source: New York Times By LISA PREVOST Published: January 17, 2013

Underwater Sellers, what are your Options? Cash to Short Sell? Cash for Keys? Foreclosure?

We get these questions and would like to share our thoughts about this dilemma. Some home owners who are underwater may not know their alternatives. The “Cash for Keys” is a program that banks do for some home owners. The “new twist” you’ll be hearing more about is “Cash to Short Sale”. Lenders are figuring out that if there is anything they can do to make a deal happen, they need to do it. This apparently is what is starting to take place with people that are trying to “short sale” their homes. Instead of “Cash for Keys” to homeowners that lose their homes to foreclosure. This was not offered to home owners who were trying to short sale their home. Often the banks would basically give them a certain time to complete the short sale until they foreclosed.

Now because of tight lending practices, new buyers would take so long to qualify, it is often “too little, too late” to close escrow before foreclosure. When that happens it seems everybody loses. The lenders lost a willing & able buyer and the seller because, now, not only did they lose their home to a foreclosure, but also because a foreclosure was now on their credit report instead of a short sale. (It may be better to have a short sale than a foreclosure on a credit report?) Plus, the buyer may or may not wait until the home came back on the market at a later date.

Source: http://realtyworld-sierraproperties.com by Douglas Zeller