Warning Regarding Online Rental Schemes

By Wayne S. Bell, Real Estate Commissioner

California Bureau of Real Estate

Issued: October 2013

In prior consumer alerts, the California Department of Real Estate, the predecessor of the California Bureau of Real Estate (“CalBRE”) issued warnings to prospective renters about (i) imposter landlords and (ii) scams perpetrated by or in connection with Prepaid Rental Listing

Services.

There are almost endless varieties of real estate and rental fraud. Some are new. Many are old, and some are just variations on timeworn scams.

CalBRE has received reports and been made aware of online rental scams (often using such Internet sites such as Zillow, Trulia, Craigslist, and HotPads), and we want to warn the public about some of the most common ones.

Included in this warning is a list of “red” flags or signs to look for, suggestions on how prospective renters can protect themselves, and reporting recommendations for those potential renters who have been victimized.

Common Scams

In most cases, the fraud involves a scammer who:

- Duplicates or “hijacks” an actual listing of a property that is for rent.

- Creates a fake or fictitious listing for a rental property.

- Offers for rent a real, but unavailable, property.

- Rents a property that is in foreclosure and which will soon be sold, or that has been fully foreclosed (or is in pre-foreclosure).

In the cases mentioned above, the perpetrators do not own the properties (although they oft-times pretend to be the owners) and they are not authorized or licensed to rent the properties.

In most of these cases, the scammers collect money (usually via wire transfer) from the victims for deposits, fees and rents, and in a number of the cases obtain enough personal information, such as social security, driver license and bank account numbers, to steal the identities of the “renter” victims.

For the fraudsters, these are crimes of opportunity and they are simply taking advantage of individuals who are looking for rental housing in a tight real estate market. The perpetrators engage in these crimes (via the Internet ether) because they have found success with such scams and continue to find victims who send money and/or who provide personally identifying information that can be used by the scammers to commit additional crimes.

Please see Consumer Alert – Beware of Imposter Landlords and Consumer Fraud Alert and Warning – Prepaid Listing Services (PRLS).

Because of the anonymity and widespread availability of the Internet, an online rental scam can be started and operated from anywhere in the United States or in other countries.

“Red” Flags

While none of the “red” flags below is definitive proof of fraud, the following are warning signs of a possible scam:

- The advertised rental rates are low (many times very low) compared to other rentals in the area. Always remember the time-tested adage that if something seems too good to be true, it probably is.

- The purported landlord or agent requests that the advance payment of rents and deposits (and possibly other fees) be made via cash or wire transfer (such as Western Union), and/or asks for personal information such as social security number, bank account information, and driver license number. It is important to note that payments made by cash or wire transfer provide little – and usually no – recourse, especially since the scammer to whom the funds are wired usually disappears and cannot be found. While credit card payments are not accepted by many landlords or property rental agents, prospective renters should – to provide an amount of self-protection – ask to pay for rents, deposits and fees by credit card.

- The supposed owner or rental agent is either out of the country or in another State, or is in a hurry to leave California, and states that the rental property cannot be shown or toured.

- The prospective landlord or property agent is not willing to meet in person, and/or applies pressure to complete the rental transaction as soon as possible.

Ways that Prospective Renters Can Protect Themselves

The best advice for prospective renters is to be wary, and to conduct their own diligence and investigate the person with whom they are dealing or negotiating, and the property itself. In this regard, potential renters should:

- Confirm or verify the identity of the supposed landlord or property agent. To see who owns the property, contact a licensed California real estate agent, the county recorder’s office in the county where the property is located, and/or a title company. Talk with neighbors about the property and ask who owns it, and ask a lot of questions about the rental history of the property. If dealing with a property manager or leasing agent (who does not live at the property), look them up on the CalBRE website (www.bre.ca.gov) to see if they are licensed. If they are, check to see if they are disciplined or otherwise restricted in the real estate practice that they can do. Also, check the person out on Google or other search engines, and through the Better Business Bureau.

- Confirm that the property is not in foreclosure or pre-foreclosure. This is especially true when renting a house. The mortgage loan should be in good standing and not in default.

- Not rent a property without viewing and touring it in person.

- Not pay or transfer any money without reviewing all rental documents, and getting copies of all writings pertaining to the property.

- Demand to meet and then actually meet the supposed owner or property manager in person, and ask many questions about the property and the neighborhood.

- Work with an experienced, competent, and licensed California real estate broker, or salesperson working under the supervision of a broker.

- Take photographs of the property.

- Not pay anything in cash or wire transfer money.

- Do research on what comparable properties rent for.

The essential point here is that prospective renters, in order to protect their interests, and not become a scammer’s next victim, must remain skeptical, proceed cautiously, do their own investigation of the property and individuals involved with the rental(s), and be aware of and look for revealing signs of fraud.

After Falling Victim or Becoming Aware of an Online Rental Scam

If a prospective renter has been scammed, or becomes aware of an online rental scam, he or she should immediately report the fraud and file complaints with one, more or all of the following:

- The relevant Internet provider (e.g., Zillow, Trulia, etc.).

- CalBRE if a real estate licensee is involved, or if the scammer is unlicensed and purporting to be a real estate agent. Please contact CalBRE at www.bre.ca.gov.

- The California Attorney General, at www.oag.ca.gov/consumers.

- The District Attorney, Sheriff, local police and local prosecutor in your community.

- The Federal Trade Commission, at www.ftc.gov.

- Federal Bureau of Investigation (FBI), at www.fbi.gov.

- The Consumer Financial Protection Bureau at www.cfpb.gov.

Issued: October 2013

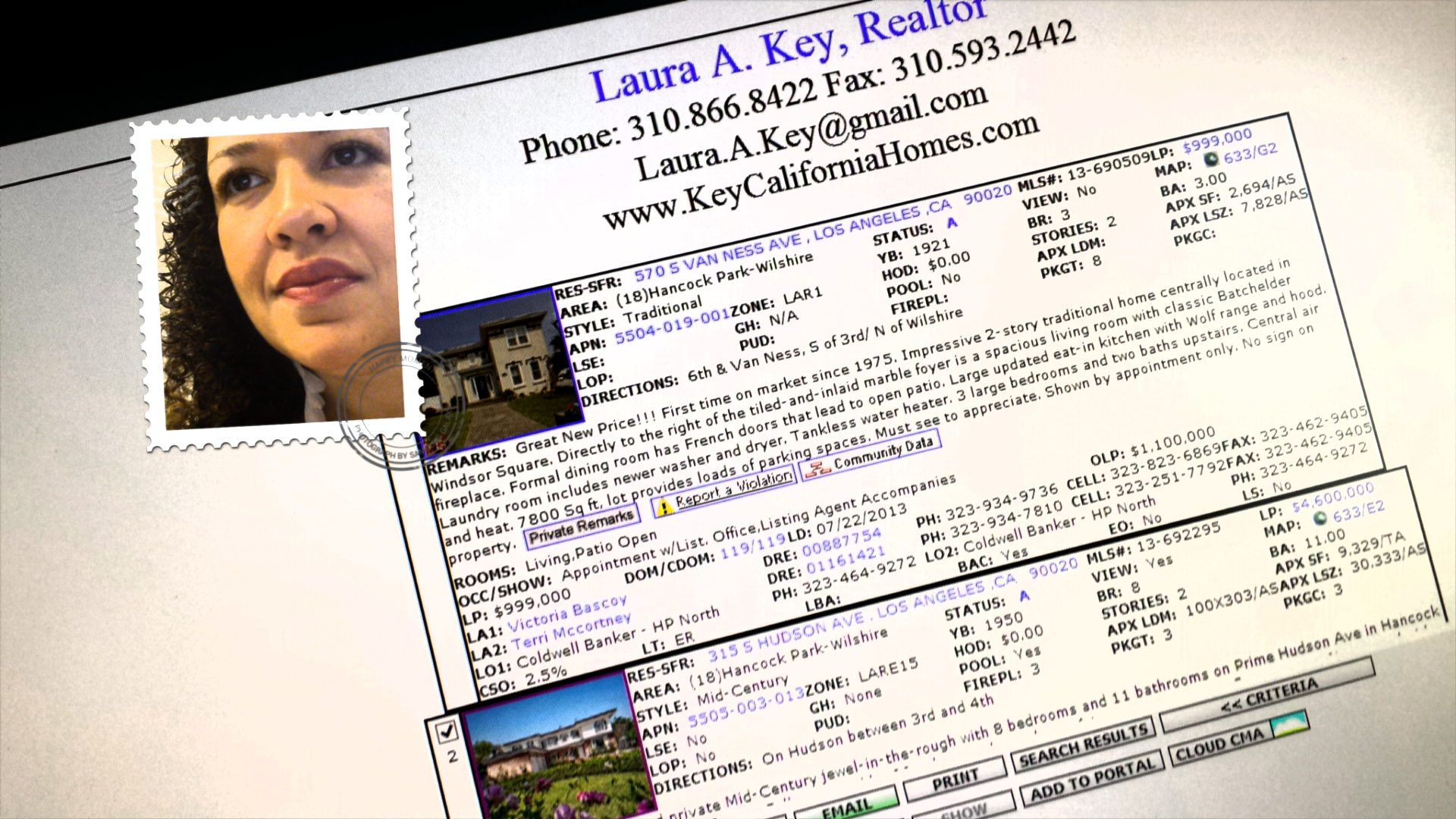

Call Laura Key for your real estate needs, rentals, sales, purchase, investment! 310.866.8422 Search for homes NOW!

Call Me for More Details 310.866.8422

Call Me for More Details 310.866.8422