BLOG

DIY Bucket List

This is a wonderful story about making their house a home! With so many options out there today it's hard to choose what you want in your own home.

More Sellers Jump Into Favorable Market

More sellers are ready to put their homes on the market for the awaiting buyers. They are getting top dollar! If you have been thinking of selling, give me a call for a FREE Comparative Market Analysis and let's begin the process! Laura Key 310.866.8422

Inventories of for-sale homes are increasing as more owners see rising home prices and faster sales as a reason to try to sell now, according to industry reports.

In April, the number of listings was higher than the level of homes that were under contract in that month, according to a study by the real estate brokerage ZipRealty, which measured listings in 24 major metro markets.

“It’s less of an indication of buyer momentum flagging and more of seller momentum picking up, finally,” says Lanny Baker, the company’s chief executive.

The reports find that homes are selling faster—on average, within 32 days of being listed. In April 2012, that average stood at 48 days for homes to sell.

“A market in which the sale prices are happening very close to the list prices, a market in which the list prices seem to be moving sequentially higher, and a market in which any of those houses are selling speedily is one that is bringing sellers back,” Baker says. “That makes it feel to a seller that this isn’t going to be a long passive despair that I tried three years ago.”

Source: “Why More Sellers Could Test the Market,” The Wall Street Journal (June 10, 2013)

Want an estimate of what your California home is worth? Fill out the form below! All info is confidential and will not be sold!

[contact-form][contact-field label='Name' type='name' required='1'/][contact-field label='Email' type='email' required='1'/][contact-field label='Address' type='text' required='1'/][contact-field label='City%26#x002c; State%26#x002c; Zip' type='text' required='1'/][contact-field label='Number of Bedrooms' type='text' required='1'/][contact-field label='Number of Bathrooms' type='text' required='1'/][contact-field label='When are you interesting in putting your home on the market?' type='select' options='0-3 Months,4-6 Months,7-9 Months,10-12 Months'/][contact-field label='Please enter any other important features about your home? Upgrades%26#x002c; Garage%26#x002c; etc.' type='textarea' required='1'/][/contact-form]

Do Pets Make A Home Complete?

Some say a house is not a complete home without a pet? What are your thoughts? Meet Chewbacca and Fizgig, my furry babies!

I grew up in the country in a little country town in Kentucky. When I was coming up we only had outdoor pets. So naturally 11 years ago when my husband and I purchased our first home I started to get the gentle heartstring plugs of wanting a dog. After much discussion and concern due to allergies, we proceeded to head out and get Chewbacca who is a full blood Shih Tzu. Chewbacca is gentle, warm, kind loving, and just a special being and I enjoy having him around. Well, after two years we thought maybe Chewbacca needed a companion. So off we went and ended up with Fizgig who is also from the same parents of Chewbacca but has a totally different view on life. He's stubborn, he barks, he is a little Tasmanian devil. But he is still my furry baby and both of my pets do something every single day that warms my heart and lets me know they love me as much as I love them. It's nothing like coming home to two little warm fuzzy faces who are happy to see you. Chewbacca and Fizgig bring both my husband and I untold joy!

I grew up in the country in a little country town in Kentucky. When I was coming up we only had outdoor pets. So naturally 11 years ago when my husband and I purchased our first home I started to get the gentle heartstring plugs of wanting a dog. After much discussion and concern due to allergies, we proceeded to head out and get Chewbacca who is a full blood Shih Tzu. Chewbacca is gentle, warm, kind loving, and just a special being and I enjoy having him around. Well, after two years we thought maybe Chewbacca needed a companion. So off we went and ended up with Fizgig who is also from the same parents of Chewbacca but has a totally different view on life. He's stubborn, he barks, he is a little Tasmanian devil. But he is still my furry baby and both of my pets do something every single day that warms my heart and lets me know they love me as much as I love them. It's nothing like coming home to two little warm fuzzy faces who are happy to see you. Chewbacca and Fizgig bring both my husband and I untold joy!

In case you are wondering where the names came from, my husband is a movie buff. Of course most know Chewbaccca is from Star Wars but most do not know where the name Fizgig came from. Fizgig has his name from the little dog like creature in "The Dark Crystal" and if you know that movie, then you know exactly how my little monkey acts!

So what are you thoughts? Is a house not a complete home without a pet?

Ready to create memories in your own home? Start your journey by attending a FREE homebuyers workshop. You will find info from credible lender's, the homebuying process taught by me, and lots more such as...what is escrow...Do I have to have an inspection? Contact me today for a class schedule!

Home is Where the Heart Is? Are You Ready?

Home is where you create wonderful memories! One of my favorite things is when my family comes for the holidays and we all gather in the kitchen and work on dinner. We have so much fun laughing and preparing dishes that have been handed down through the generations. Then after dinner we gather around piano and sing, sing, sing! Home.....are you ready?

Find your home now for free! Click below!

Return to 'Buyer's Market' Still Years Away

Even though it's tough for buyers right now, I never say it's IMPOSSIBLE! Buyer who are patient and stay the course can find a home! Call me today! Free Homebuyers classes coming soon! Register Now! Laura Key 310.866.8422

It may be two to three more years before prospective home buyers get a break from escalating property prices and tight supply, according to experts speaking at a National Association of Real Estate Editors conference Wednesday.

That is the time frame for institutional speculators, who currently are dominating the market, to pull out of their investments and still make a profit, explained Bill Rayburn of the mortgage technology firm FNC. The market also will need to see the return of individual home buyers in order to normalize, he said, which will be propelled by employment gains.

Source: "Better Times for Home-Buyers Will Take a Few Years, Experts Say," Los Angeles Times (June 5, 2013)

Search for homes now...It's FREE!

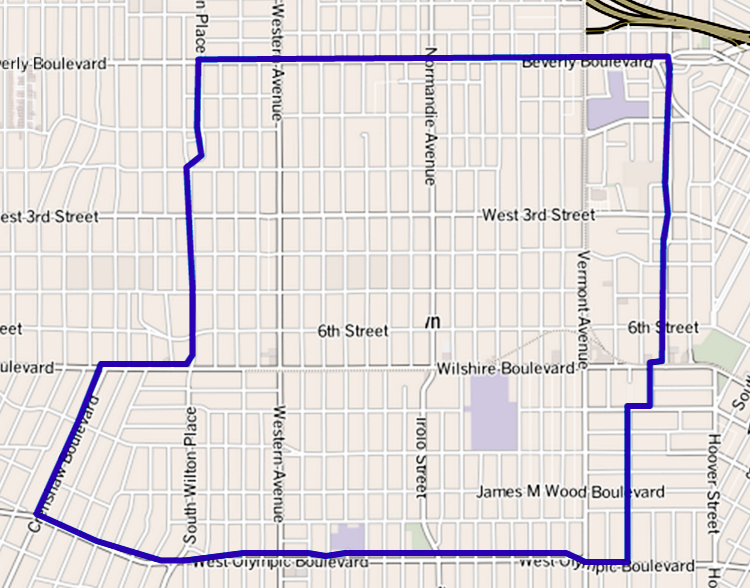

Living in Koreatown Los Angeles

Los Angeles is home to so many wonderful areas to live in. If you are interested in Koreatown, give me a call! Laura Key 310.866.8422 or just click the Koreatown Ball below!

Koreatown is a wealth of history and excitement! You can hardly take two steps without finding a new place to eat or shop! I must admit, after living here for almost two years I have not even scratched the surface of what is offered in this great area of Los Angeles until I saw the CNN Special with Anthony Bourdain Parks Unknown! Sometimes the boob tube can really spur you into action.

Koreatown is a wealth of history and excitement! You can hardly take two steps without finding a new place to eat or shop! I must admit, after living here for almost two years I have not even scratched the surface of what is offered in this great area of Los Angeles until I saw the CNN Special with Anthony Bourdain Parks Unknown! Sometimes the boob tube can really spur you into action.

I decided it was time to visit some of the places shown during this special. My first adventure was trying Myung In Dumplings located at 3109 W. Olympic Blvd. The power of TV had already overwhelmed this place. The first time my husband and I visited they had sold out of most of their menu, so we attempted to fill our bellies on another day! On our second visit we were able to order the #1 which is meat and veggie dumplings. While we were in line waiting it was such a pleasure to watch the owners actually making the dumplings by hand. It's something about seeing loving hands prepare food. Reminds me of growing up in Kentucky and our Sunday dinners! For $7 we were given four nice sized fluffy dumplings filled with yummy delights on the inside! Along with our dumplings we were given a few kimchee delights!

Overall, it was a very pleasant outcome to my first new adventure of Koreatown! Join me on my next adventure in the near future!

Interested in living in Koreatown? Please visit my website to search for homes FREE! Just click the map below! Or...call me, Laura Key 310.866.8422

4 Big Drivers of the Housing Market Recovery

There seems to be a light at the end of the tunnel and it's getting brighter each day! Let's Get YOU a home! Laura Key 310.866.8422

The Wall Street Journal highlighted four primary reasons why the housing market recovery is strong. They are:

- Sales have made big leaps from year-over-year levels. Existing-home sales are up 9.7 percent compared to one year ago. Sales are at an annual rate of 4.97 million, which is the highest level since November 2009, according to NAR. Despite constrained inventories and recent price gains, home sales continue to post increases.

- Non-distressed home sales are increasing. Home buyers are showing high demand for non-distressed homes. In April, about 18 percent of sales were in foreclosure or a short sale — down from 28 percent year-over-year.

- Inventories have increased. In April, the number of homes for sale rose 11.9 percent from March. The limited supply — mixed with rising buyer demand — has helped home prices to rise around 10 percent year-over-year. “Rising inventory should ultimately slow some of the price rally while boosting sales volumes, helping to restore equilibrium in the housing market,” The Wall Street Journal reports.

- Homes are selling a lot quicker. About half of all homes that were sold in April were on the market for 46 days, down from 83 days one year earlier, according to NAR data.

Search for your next home FREE! Visit me on Facebook and search NOW!

Source: “Four Reasons Why Home Sales Are Looking Healthy,” The Wall Street Journal (May 22, 2013)

When It Comes to Wood Floors, Choose Wisely

Rich wood flooring can spell instant warmth and patina in a home. Here’s an overview that can help you evaluate if wood floors are right for you! Laura Key 310.866.8422

Just as with ties and hem lengths, wood flooring styles change. Colors get darker or lighter; planks get narrower or wider; woods with more or less grain show swings in popularity; softer or harder species gain or lose fans; and the wood itself may be older, newer, or even pre-engineered with a top layer or veneer-glued to a substrate to decrease expansion and contraction from moisture.

Here are key categories for consideration:

Solid Plank

This is what some refer to as “real” wood because the wood usually ranges from three-eighths to three-quarters of an inch in total thickness to permit refinishing and sanding. Thicker floors have a thicker wear layer to allow for more frequent refinishing and sanding, so they can withstand decades of use, says architect Julie Hacker of Stuart Cohen and Julie Hacker Architects. It also can be stained, come from different species of tree, and be sold in numerous widths and lengths:

- Width and length: Designer Steven Gurowitz, owner of Interiors by Steven G., is among those who prefers solid flooring for many installations because of its rich, warm look. Like other design professionals, he’s seeing greater interest in boards wider than the once-standard 2 ¾ to 3 ¾ inches — typically 5 to 6 inches now but even beyond 10 inches. And he’s also seeing corresponding interest in longer lengths, depending on the species. Width and length should be in proportion. “The wider a board gets, the longer the planks need to be, too, and in proportion,” says Chris Sy, vice president with Carlisle Wide Plank Floors. These oversized dimensions reflect the same trend toward bigger stone and ceramic slabs. The downside is greater cost.

- Palette: Gurowitz and others are also hearing more requests for darker hues among clients in the northeastern United States, while those in the South and West still gravitate toward lighter colors. But Sprigg Lynn, on the board of the National Wood Flooring Association and with Universal Floors, says the hottest trend is toward a gray or driftwood. Handscraped, antique boards that look aged and have texture, sometimes beveled edges, are also become more popular, even in modern interiors, though they may cost much more.

- Species and price: Depending on the preference of the stain color, Gurowitz favors mostly mahogany, hickory, walnut, oak, and pine boards. Oak may be the industry’s bread and butter because of the ease of staining it and a relatively low price point. A basic 2 ¼-inch red oak might, for instance, run $6.50 a square foot while a 2 ¼-inch red oak that’s rift and quartered might sell for a slightly higher $8.50 a square foot.

- Maintenance: How much care home owners want to invest in their floors should also factor in their decision. Pine is quite soft and will show more wear than a harder wood like mahogany or walnut, but it’s less expensive. In certain regions such as the South, pine comes in a harder version known as heart pine that’s popular, says Georgia-based designer Mary Lafevers of Inscape Design Studio. Home owners should understand the different choices because they affect how often they need to refinish the wood, which could be every four to five years, says Susan Brunstrum of Sweet Peas Design-Inspired Interior. Also, Sy says that solid planks can be installed over radiant heating, but they demand expert installation.

Engineered Wood

Also referred to as prefabricated wood, this genre has become popular because the top layer or veneer is glued to wood beneath to reduce expansion and contraction that happens with solid boards due to climatic effects, says Sy, whose firm sells both types. He recommends engineered, depending on the amount of humidity. If home owners go with a prefabricated floor, he advises a veneer of at least one-quarter inch. “If it’s too thin, you won’t have enough surface to sand,” he says. And he suggests a thick enough substrate for a stable underlayment that won’t move as moisture levels in a home shift.

His company’s offerings include an 11-ply marine-grade birch. The myth that engineered boards only come prestained is untrue. “They can be bought unfinished,” he says. Engineered boards are also a good choice for home owners planning to age in place, since there are fewer gaps between boards for a stable surface, says Aaron D. Murphy, an architect with ADM Architecture Inc. and a certified Aging in Place specialist with the National Association of Home Builders.

Reclaimed Wood

Typically defined as recycled wood — perhaps from an old barn or factory — reclaimed wood has gained fans because of its aged, imperfect patina and sustainability; you’re reusing something rather than cutting down more trees. Though less plentiful and more expensive because of the time required to locate and renew samples, it offers a solid surface underfoot since it’s from old-growth trees, says Lynn. Some companies have come to specialize in rescuing logs that have been underwater for decades, even a century. West Branch Heritage Timber,for instance, removes “forgotten” native pine and spruce from swamps, cuts them to desired widths and lengths, and lays them atop ½-inch birch to combine the best of engineered and reclaimed. “The advantage is that it can be resanded after wear since it’s thicker than most prefabricated floors, can be laid atop radiant mats, and doesn’t include toxins,” Managing Partner Tom Shafer says. A downside is a higher price of about $12 to $17 a square foot.

Porcelain “Wood”

A new competitor that closely resembles wood, Gurowitz says porcelain wood offers advantages: indestructibility, varied colors, “graining” that mimics old wood, wide and long lengths, quickness in installation, and no maintenance. “You can spill red wine on it and nothing happens; if there’s a leak in an apartment above, it won’t be destroyed,” he says. Average prices run an affordable $3.50 to $8 a square foot. The biggest downside? It doesn’t feel like wood since it’s colder to the touch, Lynn says.

Bottom Line

When home owners are making a choice or comparing floors, Sy suggests they ask these questions:

1. Do you want engineered or solid-based floors, depending on your home’s conditions?

2. Do you want a floor with more natural character, or less?

3. What board width do you want?

4. How critical is length to you in reducing the overall number of seams?

5. What color range do you want — light, medium, or dark?

6. Do you want more aggressive graining like oak or a mellower grain like walnut?

7. Do you want flooring prefinished or unfinished?

8. How thick is the wear layer in the floor you’re considering, which will affect your ability to refinish it over time?

9. What type of finish are you going to use? Can it be refinished and, if so, how?

10. For wider planks that provide greater stability: Where is the wood coming from, how is it dried, what is its moisture content, and what type of substrate is used in the engineered platform?

Thinking of selling your home? A little investment can increase your resale value! Call me for a personal consultation! Laura Key 310.866.8422

What To Ask When Looking At Potential Homes

Buying a house can be an intimidating and overwhelming experience. Here are some key questions to ask yourself and sellers before plopping down a down payment. Let me help you with my FREE homebuyer's class! Call me today! Laura Key 310.866.8422

Buying a house can be an intimidating and overwhelming experience. Here are some key questions to ask yourself and sellers before plopping down a down payment.

What To Ask When Looking At Potential Homes

Following is a list of general questions you should always ask when considering making a real estate purchase. Keep in mind, however, you are unique.

You have particular dislikes and likes as well as factors in your life that are different than other people. The point I am trying to make is that you shouldn’t stick to just these questions. You are making an important choice, so give some thought to your situation.

1. Don’t rush into things. The first question to ask should be directed at yourself. What type of home do you want? How big should it be? What amenities do you want? Are you planning for a family in the next three to five years and will the home be able to accommodate a new bundle of joy? Make a definitive list and stick to it. If you stray from it, you could end up with a house that doesn’t really fit you and suffer buyer’s remorse.

2. The next question is what area do you want to live in? Pick a few. You may find the prices to be excessive or the selection not so hot, but make sure you exhaust those areas before moving on. Again, you want to avoid buyer’s remorse.

3. Once you start looking at homes, a key question to ask is how long the house has been on the market. The amount of time will give you an idea of how flexible the owner is on price. If the house has been on the market for a month, the owner isn’t going to be very flexible. If it has been on the market for six months, flexibility will definitely exist.

4. Has the house previously been in escrow, but fell out? If so, find out why? Was it a problem with the buyer getting financing or did the buyer find out there was something wrong with the home?

5. What kind of condition is the house in and how old is it? Remember that a seller has typically done everything reasonably possible to spruce up the home. If you can see wear and tear on the house, it may be a red flag. In such a situation, you need to get a home inspection to make sure there aren’t problems in areas you can’t see such as mold, rust and water leaks.

6. If you have children or are planning on it, you must investigate the school district. Are the schools good? Are there gangs or crime in the area?

7. In addition to the home price, you should ask whether there are any additional fees such association fees.

8. What are the property taxes and what will they be when you buy? Many people are shocked to find out how much they have to kick out in property taxes. Don’t get surprised.

9. Zoning and easement issues are often overlooked when buying a home. If you are buying in a neighborhood with many homes, zoning is undoubtedly going to be for residential living. Easements, however, can be nasty surprises. Find out if there are any easements on the property. An easement gives a third party the right to use of part of the property. This can include giving the neighbor the right to do something or a utility company to place structures on your prospective property.

10. Noise is another big issue to consider. If you are serious about the property, make sure to drive buy on weekdays and weekends. If the property shares a wall with another residence, such as a duplex or condo, make sure you view it while the neighbors are home to get an idea of how loud it is.

11. In the euphoria of buying a property, practical issues can be missed. A big one is traffic. Specifically, what is the commute like between the house and your place of work? You don’t want to buy the house only to find out it takes three hours to get to and from work each day.

Obviously, you should be asking many additional questions before making a purchase. These 11 questions, however, will help you get started. Call me to schedule a time to discuss the homebuying process in more detail. Don’t forget to look into fun things to do in the area to make sure it’s where you want to live!I care about my clients and educating them is a priority! Laura Key 310.866.8422 or email me at Laura.A.Key@gmail.com

What to Expect At a Foreclosure Auction

Whether you are an investor that would like to get into buying foreclosed homes for your personal use! Call me today! Laura Key 310.866.8422

Whether you are an investor that would like to get into buying foreclosed homes for your personal use or to flip the property or if you are having your home foreclosed on, you should know what to expect at a foreclosure auction. Of course, the actual steps that will be taken can vary a bit from state to state and from house to house, but it’s good to know what you will be getting into when you go to a foreclosure auction. Foreclosure auctions can be exciting, even fun, but knowing what to expect will help you make the most of the experience, whether you are an investor or a homeowner that is trying to get your house back.

Before the Auction

You’ll likely find out about the foreclosure auction in a local newspaper and on the flier may be information to pre-qualify for bidding. This will allow you to put down a deposit so that the auctioneer knows that you are a serious bidder and can fulfill your bid if you are the winning bidder. Being pre-qualified just sort of speeds up the process so that you don’t have to mess around with the deposit on the day of the auction. During this time you should also do some research on the house by looking into any liens that may be against the property, how much the property is worth, how much it has appreciated in the last few years, as well as property values in the area. If the home looks as though it will need some repairs, you should consider this as well when trying to come up with how much you will be willing to pay for the house. Without this research, no amount of knowledge about what goes on at a foreclosure option will help you because you won’t know where to start when it comes to actually making a good bid.

What Happens At the Auction

The auction will typically start with the auctioneer reading legal notices as well as a legal description of the property. The auctioneer will usually then begin taking bids on the property. If the auctioneer has pre-qualified bidders the process is more streamlined, if not, each time a bid is made the auctioneer will then ask for the bidders deposit check, which is typically right around $5,000 for residential auctions. After each bid the auctioneer will attempt to solicit bids for higher amounts. Each auction is different, but the auction increments usually are set by the auctioneer and may be by $100, $500, or $1,000 per bid. The auctioneer will continue to solicit bids by this increment until it is clear that the highest bid has been reached. Then, the auctioneer will announce, “Going once, going twice, three times, sold!” indicating that the auction is over and the property has been sold to the highest bidder.

Once the bidding has ended a foreclosure deed and purchase papers will be drawn up and validated by the new owner or purchaser and the mortgage holder. A grace will likely be given to allow the purchaser to find financing or to come up with the funds to cover the full amount of the bid. This grace period is usually 30 days unless the purchaser and the mortgage holder agree to other terms. After the grace period a closing will take place, so that the new owner can formally take the title to the property.

What Happens, Now?

The purchaser can do what he or she intended to do with the property, whether it is to move into the home or to sell it for full market value. The money paid by the purchaser will be distributed in order of priority, first of which would be taxes. After taxes money will be paid to the mortgage, then the second and third mortgage if applicable. If there is still money after paying these debts, remaining money will be paid to lien holders and creditors. There is a very slim chance that there will be money left over after all of the debts are paid, if this is the case then the monies will be paid to the former home owner.

What about the Original Owner?

The original owner will often be at the auction so that they can bid on their home, and this is legal as long as they have the deposit required. If the owner of the home that has been foreclosed does bid on the home they must remember that the deposit is not refundable and the deposit assumes that they will be able to finance the home within the grace period. Owners must also remember that if they buy the property back old debts may merge and become reinstated such as second and third mortgages that became void when the first mortgage foreclosed on the property unless one has filed bankruptcy and is truly free and clear of these debts. Owners will often drum up the funds to make the deposit so that they can have another 30 days to try to save their home. Owners may or may not be successful in their attempts to save their home at a foreclosure auction.

As you can see, there are a lot of things that go into a foreclosure auction, but none of them are all that difficult to understand, but knowing about them makes the auction more enjoyable. The auction itself is not all that complicated, but it can be very fast paced. At some foreclosure auctions there are a lot of people, at others there are only a few because of the location or just the debts attached to the property, or even the state of the property. If you are serious about the property you should pay close attention when bidding starts so that you are sure that you can get your bid in when you feel it’s time so that you have the best chance of being the top bidder.

Call me for more info! Laura Key 310.866.8422

3 Ways Renters Lose Money

Are you still renting a home or apartment for yourself or your family? If so, you're losing money. Besides losing out on making money with real estate, renters don't get the same satisfaction of home enjoyment that benefits home buyers. If you're renting, call me today to find out how to to buy your own home. Call me today! Laura Key 310.866.8422

Are you still renting a home or apartment for yourself or your family?

If so, you're losing money. Think about these three ways you lose money by renting:

1. You're paying for someone else's mortgage payment. You're missing out on the appreciation that the property gives to the landlord. Appreciation is a term used in accounting relating to the increase in value of an asset, which means in real estate terms, added value to the property. Over the past five years, houses appreciated significantly, making many new real estate investor multimillionaires.

2. Renters don't get to freeze their monthly housing expenses like home buyers can. Of course, many home buyers get mortgage payments with adjustable interest rates and their payments go up over time. However, these payments will not go up over the long term like rising rents. Just think about how much an apartment costs today compared to ten years ago. A two bedroom apartment in Lake Elsinore, California leases for $1,000 today. The exact same apartment rented for $325 in 1996, when it was brand new. Home buyers who had low monthly payments in 1996, who did not refinance their mortgage, enjoy low payments and don't have to worry about rising rents.

3. Renters don't benefit from tax advantages. Home owners get income tax deductions. Tax deductions for interest costs, for instance, save tax payers thousands of dollars.

Emotional Satisfaction of Home Ownership

Besides losing out on making money with real estate, renters don't get the same satisfaction of home enjoyment that benefits home buyers. Many landlords won't allow you to paint your walls in colors that you desire. Also, you won't feel like fixing up the property with custom window coverings and you get little say in flooring materials. Because you can't make your personal statement, you won't feel like you're HOME as much as home owners who feel emotionally connected to their property.

How to Buy Your First Home

The biggest barrier to home ownership is often accumulating funds for a down payment. People think they have to have thousands of dollars for a down payment. However, if you have good credit and a decent job, you can get a mortgage for a home with zero down. And you can finance some of your closing costs as well as ask the seller to help you pay a good portion of your purchase costs. With today's mortgage finance plans, you may be surprised to find out how much of a home you can afford with payments similar to what you currently pay in rent.

You may have to go out of the major metropolitan areas to buy a home. That's why so many people commute in Southern California. Affordable housing costs much less in outlying areas. But so do the rents. If you're renting an apartment for $2,300 in Los Angeles, you could buy a $500,000 home in Wildomar. Our daughter just purchased a home in December 2005 and her mortgage payment, for a 3,000 square foot new home, costs less than $2,300. With her tax savings, she will pay even less than renting a small apartment closer to downtown L A.

If these amounts sound high to you, check your local area. Perhaps your monthly rent is only $1,000 and houses cost less than $200,000. Talk to a mortgage loan officer and see how much of a home you can afford.

If you're renting, make one of your priorities to buy your own home.

Copyright © 2006 Jeanette J. Fisher

Homebuyers clueless about mortgages

Educating homebuyers is one of my favorite things to do! Ask me about my homebuyers class! Laura Key 310.866.8422

The housing market is heating up, yet many house hunters are not prepared to take on the biggest purchases of their lives.

When it comes to mortgages, homebuyers answered basic questions about terms, how to choose a lender and financing wrong nearly one-third of the time, according to an April survey of more than 1,000 current and prospective homeowners by real estate website Zillow.

Among the survey's findings, 31% of buyers don't think it's possible to get a mortgage for less than 5% down; 34% don't know what the term "annual percentage rate" (APR) means and one in four believe you must close with the lender that pre-approves your mortgage.

"All too often buyers focus on negotiating a lower home price and ignore the importance of finding the right loan," said Erin Lantz, director of mortgages for Zillow. "Buyers should always shop multiple lenders and compare rates and fees and read lender reviews in order to find the best loan for their situation."

One example: 34% of respondents believe lenders are required by law to charge the same fees to all clients for credit reports, appraisals and the like. That's wrong. Fees vary from bank to bank and can often be negotiated.

But it's hard to compare those deals if you don't understand what mortgage terms, like "annual percentage rate," mean. The APR factors into fees, upfront points, origination and underwriting fees and other costs that borrowers use to compare the actual cost of loans.

Such knowledge gaps can have long-term consequences. About 34% of first-time homebuyers think they need a down payment of at least 5% to make a home purchase, but loans insured by the Federal Housing Administration can require as little as 3.5% down.

And 24% of buyers believe the best mortgage deals are available through the banks where they currently have their savings and checking accounts, but often competing lenders can undercut those banks by large margins.

"If a homebuyer can lower their interest rate by even half a percentage point, they can not only increase their purchasing power, but save thousands of dollars over the life of the loan," said Lantz.

For every $100,000 borrowed, a half percentage point lower rate would reduce payments by $28 a month on a 30-year, fixed rate loan. That adds up to more than $10,000 over 30 years. Or borrowers could choose to add that $28 savings to each monthly payment. That would shorten the term of the mortgage from 30 years to just over 27 and save $6,500 in interest paid.

Another costly mistake: Many house hunters go shopping with financing in place because it enables them to act more quickly if they see a home they want. But 26% of buyers believe that once they're pre-approved, they're obligated to close the deal with those loans, according to the survey. In reality, there's no obligation. If buyers see better terms available they should take them.

Existing homeowners can also be guilty of ignorance. Some 20% of homeowners surveyed didn't know that underwater mortgages -- those in which borrowers owe more than their homes are worth -- can be refinanced into lower rate loans.

Finally, the survey found that nearly a third of homeowners are unaware that if they go through a foreclosure or short sale, they may not have to wait the full seven years it takes for their credit score to recover and they can buy a home again.

In reality, some homeowners who do short sales can obtain financing to buy another home in as little as two years.

The Consumer Financial Protection Bureau is hoping to make it easier for homebuyers with simplified mortgage forms that help them compare terms and costs and by creating new rules that will protect homeowners from getting into loans they can't afford.

Free home search here! Click the house to begin!

Source: By Les Christie @CNNMoney May 9, 2013

Definition of Prescriptive Easement

Call me if you have some questions about a Prescriptive Easement! I have a team that can help you if you have concerns! Laura Key 310.866.8422

A prescriptive easement creates a right to use another's land for a specific purpose. The easement is created by making use of the land without owner permission for a period of time specified by statute. Interference with a prescriptive easement gives the easement holder cause to bring suit.

Easement in General An easement creates a right to use land that is possessed by another for a specific purpose. One parcel of land, the "dominant tenement," enjoys the benefit of the easement, while the "servient tenement" is the land being used for the easement purpose. Once an easement is validly created, even if not used, it is presumed to be perpetual.

Prescriptive Easement A prescriptive easement is acquired when the servient tenement is used for a specific purpose, for some time without the permission of the owner. Through the continuous use and the owner's failure to stop it, the dominant tenement can acquire the right to use the servient tenement property indefinitely. A prescriptive easement is a type of easement appurtenant, meaning that the holder receives physical use or enjoyment of the property. All who may succeed to title of the dominant tenement will be entitled to the prescriptive easement; the easement need not be mentioned in the conveyance or deed in order to be operative.

Elements Speaking generally, for legal elements are usually required: adverse use (use of the servient property without permission of the owner); open and notorious use (with no attempt at concealment); continuous use for the entire statutory period (required statutory periods vary among states, but the minimum is five years); and hostility, meaning that hte easement user knowes he has no right to use the property. However, individual state' easement laws may display variations, and those with easement issues should consult a legal professional.

Exclusive Use Jurisdictions are split on weather a prescriptive easement requires that adverse use of the property be exclusive in order to fulfill the legal element. A minority of jurisdictions will not allow a prescriptive easement if other parties besides the dominant tenement have also been using the servient tenement adversely for the same use. However, most do not require exclusive use, only that the dominant tenement's right to adversely use the easement "does not depend on a like right in others". In other words, the dominant tenement may still get the prescriptive easement even if the owner or others are also using the tenement in a similar manner.

Termination of Easement As an owner may prevent establishment of a prescriptive easement by effectively ending the dominant tenements adverse use; this can be accomplished by bring suit or physically ejecting the easement user from the property. Easements can also be terminated in several ways; the easement holder can release the servient tenement from the easement; the dominant and servient tenement can merge ownership; or the servient tenement can be condemned. The servient tenement may also invalidate the easement by a sort of "reverse prescription," if the servient tenement uses the easement for a long time and the easement holder "sleeps on his rights."

Source: http://www.ehow.com/about_6501555_definition-prescriptive-easement.html

Despite Improvement in Loan-Mod Defaults, Report Raises Alarms

Sadly, loan modifications have not been very successful. Have you had your modification denied? Call me - Laura Key 310.866.8422

There are few defenders of the Obama administration’s signature loan-modification initiative, the Home Affordable Modification Program, or HAMP. But a new report released on Wednesday raised an interesting criticism of HAMP—that borrowers aren’t staying current on modified payments even though HAMP has reduced, on average, borrowers’ monthly payments by more than $400.

The report, from the special inspector general for the Troubled Asset Relief Program, or Sigtarp, said there was an “alarming rate” of homeowners who were defaulting after receiving a permanent mortgage modification.

The report says data show that the longer a homeowner remains in HAMP, the more likely he or she is to redefault out of the program. This is true of almost any mortgage-modification program.

But the report raises broader questions about whether mortgage modifications have been worth the costs, and against what yard stick success in any such program should be measured.

There are plenty of faults to find with HAMP. Officials struggled to ensure taxpayer money wasn’t wasted, so they required lots of documentation. That created new headaches: banks rejected borrowers that they said provided incomplete forms, while borrowers routinely complained that banks lost their paperwork. In an interview last year, Shaun Donovan, the housing secretary, said it was a “fair criticism that programs initially were too complicated and had too many restrictions.”

Mortgage servicers were also overwhelmed. During tense meetings at the Treasury Department throughout 2009 and 2010, officials laid into the banks for not staffing up. Executives groused that HAMP rules changed so often that they couldn’t keep up and that new headline-grabbing initiatives were announced before they could be rolled out to be offered to borrowers.

Others said HAMP didn’t do enough to deal with negative equity, which prompted the administration to launch a belated effort two years ago to encourage principal reduction. The Treasury never made it mandatory because they feared it would both be too expensive and that it would lead banks to opt out of HAMP.

Under HAMP, banks received modest incentive payments to reduce borrowers’ monthly payments to around 31% of their current income, often by extending the loan term and dropping the interest rate. Modifications have resulted in an average monthly payment reduction of $545 or $400, depending on which type of modification lenders provide under the program.

So far, around 860,000 borrowers have active HAMP modifications, and around 290,000 have fallen out of the program. The Sigtarp report said it was “alarming” that 46% of a few thousand permanent modifications made in the third quarter of 2009 had redefaulted, as well as 39% of those made in the last quarter of 2009.

But some industry executives have said that, for all its faults, HAMP succeeded in giving the industry a template for a more sustainable loan modification. Before 2009, many modifications didn’t result in lower monthly payments, and mortgage modifications in the post-HAMP world have performed drastically better than those that came before. Around 25% of borrowers who received a modification in 2011 had fallen behind on payments within one year, down from 57% in 2008, according to banking regulators.

Moreover, more recent HAMP modifications are performing significantly better than earlier HAMP “mods,” something that may be owed to an improving economy as much as any program improvements. Around 11% of HAMP modifications made in late 2011 had defaulted after one year, compared with more than 20% for those made when the program launched in mid-2009.

Data also show that HAMP modifications, which typically offer the most generous payment relief, perform better than privately issued modifications.

Among the bigger questions raised by the report: If mortgage modification redefault rates under HAMP are too high, what’s an acceptable level? And can any mortgage modification program hit those targets?

Source: Wall Street Journal

Does HUD Offer Special Programs for Homebuyers?

Buying a HUD Home is not as difficult as you may think! I have helped many people purchase their 1st Home from HUD! Call me today for more details about the process! Laura.A.Key@gmail.com or Visit my website to sign up for FREE HUD Listings! http://www.KeyCaliforniaHomes.com

Yes, HUD offers a program called the GOOD NEIGHBOR NEXT DOOR PROGRAM for Police Officers, Firefighters, EMT and Teachers! Call for more details on this program! 310.866.8422. If foreclosures are not sold within six months, HUD will sell them for $1 each to approved nonprofit organizations and government agencies. Homes must then be used create housing for families in need or to benefit neighborhoods.

Los Angeles HUD homes, Buying A Hud Home, North Hollywood HUD homes, Westchester HUD Homes, Gardena HUD Homes, Northridge HUD Homes, Santa Clarita HUD Homes, Simi Valley HUD homes, Lemert HUD Homes, Compton HUD Homes, Lynwood HUD Homes, Hawthorne HUD Homes, Inglewood HUD Homes, Baldwin Hills HUD Homes, Playa del rey HUD homes, Marina del Rey HUD Homes, Santa Monica HUD homes, Lakewood HUD homes, Buying A HUD Home, Buying a Los Angeles HUD Home, HUD Trained Agent, HUD NAID agent, Good Neighbor Next Door

Does HUD Offer Financing On Their Homes?

Buying a HUD Home is not as difficult as you may think! I have helped many people purchase their 1st Home from HUD! Call me today for more details about the process! Laura.A.Key@gmail.com or Visit my website to sign up for FREE HUD Listings! http://www.KeyCaliforniaHomes.com

HUD does not provide direct financing to buyers of HUD Homes. Buyers must obtain financing through either their own cash reserves or a mortgage lender. If you have the necessary available cash or can qualify for a loan (subject to certain restrictions) you may buy a HUD Home. While HUD does not provide direct financing for the purchase of a HUD Home, it may be possible for you to qualify for an FHA-insured mortgage to finance the purchase.

Los Angeles HUD homes, Buying A Hud Home, North Hollywood HUD homes, Westchester HUD Homes, Gardena HUD Homes, Northridge HUD Homes, Santa Clarita HUD Homes, Simi Valley HUD homes, Lemert HUD Homes, Compton HUD Homes, Lynwood HUD Homes, Hawthorne HUD Homes, Inglewood HUD Homes, Baldwin Hills HUD Homes, Playa del rey HUD homes, Marina del Rey HUD Homes, Santa Monica HUD homes, Lakewood HUD homes, Buying A HUD Home, Buying a Los Angeles HUD Home, HUD Trained Agent, HUD NAID agent

HUD-Owned Homes Expected to Surge

Soon the market will be filled with new listings from HUD! Are you prepared? Make sure you use an agent who is HUD experienced and can help you find the home of your dreams. I have closed many HUD homes in the past few years! Let me assist you! Laura Key 310.866.8422

The U.S. Department of Housing and Urban Development is reportedly going to be releasing more of its homes to the market, which could be welcome news to buyers who have faced slim pickings in for-sale inventories.

Over the next two years, experts predict that HUD homes on the market will increase significantly as lenders work through the backlogs of foreclosures and foreclosure reviews.

“The inventory is there, [it’s] just not being released during the banks/servicers review of the loan/mortgage documents,” says Nat Genis, a HUD listing broker in Riverside County, Calif., which is already seeing an increase in HUD-owned homes.

"HUD homes are back," Genis told HousingWire. "FHA financing went away with the 'creative' financing of the 80/20 loans, and now with the increase of FHA financing, these government-backed loans guarantee that if the borrower defaults, HUD will pay off the mortgage, obtain the deed, and re-sell the home."

HUD-owned homes can be appealing because of the discounted sales price, even though they can be in poor condition often times, HousingWire reports.

HUD had 39,442 homes in its REO inventory nationwide as of Feb. 28, 2013—with 20,536 of those having pending contracts on them, according to HUD.

Source: “HUD homes add to inventory-starved market,” HousingWire (April 29, 2013)

Do I Need An Appraisal On A HUD Home?

Buying a HUD Home is not as difficult as you may think! I have helped many people purchase their 1st Home from HUD! Call me today for more details about the process! Laura.A.Key@gmail.com or Visit my website to sign up for FREE HUD Listings! http://www.KeyCaliforniaHomes.com

It is not necessary to have a HUD home independently appraised, HUD offers an appraisal every 6 months. Your Lender may require a more current appraisal than the one provided by HUD. Ask your loan officer or HUD registered agent.

Los Angeles HUD homes, Buying A Hud Home, North Hollywood HUD homes, Westchester HUD Homes, Gardena HUD Homes, Northridge HUD Homes, Santa Clarita HUD Homes, Simi Valley HUD homes, Lemert HUD Homes, Compton HUD Homes, Lynwood HUD Homes, Hawthorne HUD Homes, Inglewood HUD Homes, Baldwin Hills HUD Homes, Playa del rey HUD homes, Marina del Rey HUD Homes, Santa Monica HUD homes, Lakewood HUD homes, Buying A HUD Home, Buying a Los Angeles HUD Home, HUD Trained Agent, HUD NAID agent

How Much Money Will I Have to Put Down on a HUD Home?

Buying a HUD Home is not as difficult as you may think! I have helped many people purchase their 1st Home from HUD! Call me today for more details about the process! Laura.A.Key@gmail.com or Visit my website to sign up for FREE HUD Listings! http://www.KeyCaliforniaHomes.com

If the bid price is less than $50,000, you’re required to make an earnest money deposit of $500. HUD homes priced greater than $50,000 require a $1000 deposit.

Los Angeles HUD homes, Buying A Hud Home, North Hollywood HUD homes, Westchester HUD Homes, Gardena HUD Homes, Northridge HUD Homes, Santa Clarita HUD Homes, Simi Valley HUD homes, Lemert HUD Homes, Compton HUD Homes, Lynwood HUD Homes, Hawthorne HUD Homes, Inglewood HUD Homes, Baldwin Hills HUD Homes, Playa del rey HUD homes, Marina del Rey HUD Homes, Santa Monica HUD homes, Lakewood HUD homes, Buying A HUD Home, Buying a Los Angeles HUD Home, HUD Trained Agent, HUD NAID agent